September 21, 2023

Fuel transition for shipping

Biofuel investment by the largest shipper.

Billionaire Maersk Family Forms Green Methanol Firm for Shipping

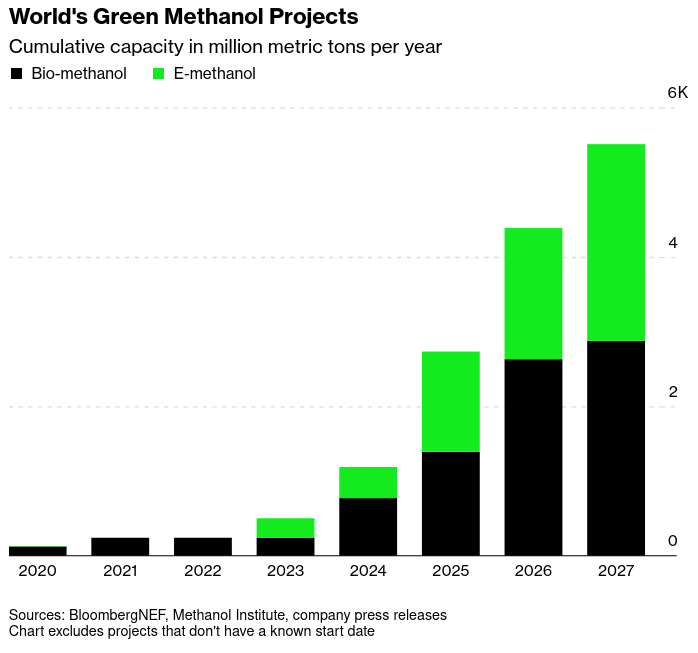

- C2X to produce 3 million tons of the alternative fuel by 2030

- Maersk alone is responsible for 0.1% of human CO2 emissions

- current production: 153,000 tons of green methanol

- with investment: 3M tons by 2030

- Demand: APMH estimates 2050 global demand for methanol: 300 million tons a year

More than 95 percent of ships today are powered by internal-combustion engines (ICEs) that run on various petroleum products, such as heavy fuel oil (HFO),marine gas oil (MGO), and marine diesel oil (MDO). (McKinsey)

No matter how we cut it, shipping fuel alternatives are hard to make green.

- It is a response to climate change, but also to the problem of removing sulfur from current fuel emissions.

- The implementation of sulfur reduction regulations on ships (called IMO 2020) potentially added about 0.2C to the North Atlantic region.

- The issue is that green methanol competes with food for production.

- Some shippers have shifted to LNG, which reduces CO2 and increases methane leaks.

- Other alternatives include ammonia-related fuel. "Green" ammonia production also produces green hydrogen. However, as a fuel it is a fertilizer competitor and a competitor with green electricity generation (since it takes green electricity for the electrolysis). Blue (using natural gas) and black (using coal) hydrogen generation processes are the current majority process for ammonia production. Blue hydrogen (and thus ammonia) production requires functional and economic sustainable carbon capture and storage. CCS technology does not currently exist or work at scale.

- Using wind energy for methanol production delivers 94% reduction in well-to-wake emissions. This also competes with green electricity generation.

- New trials include using sails on ships, though this is in its infancy with only 1-2 ships globally testing this technology.

The impact of this shift to a new fuel will change the maintenance of ships and transport technologies. Major investment in the production, refinement, and transport of the fuels will follow. Along with storage and refueling stations at ports.

All of these solutions are significantly different from current bunker diesel.

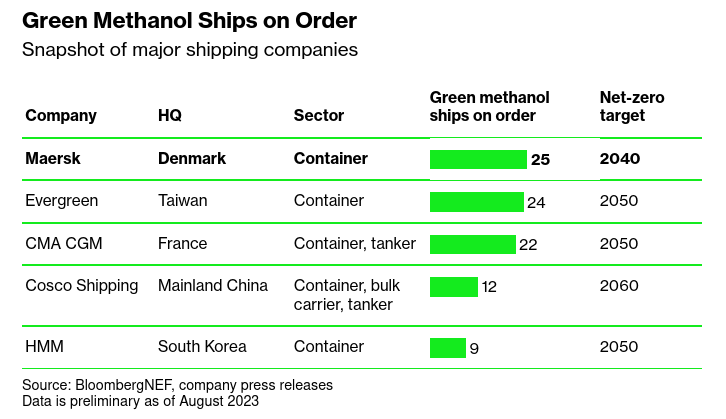

Maersk has ordered 25 green methanol ships, with the first due to be named by European Commission President Ursula von der Leyen in a ceremony later on Thursday in Copenhagen.

Cargill's new test ship with sails.

The global shipping industry has so far refused to set a firm commitment to reaching net zero by 2050 in line with the Paris Agreement. But last month, the International Maritime Organization agreed to aim for at least a 20 per cent reduction in shipping emissions by 2030 and a minimum reduction of 70 per cent by 2040. (Dezeen)

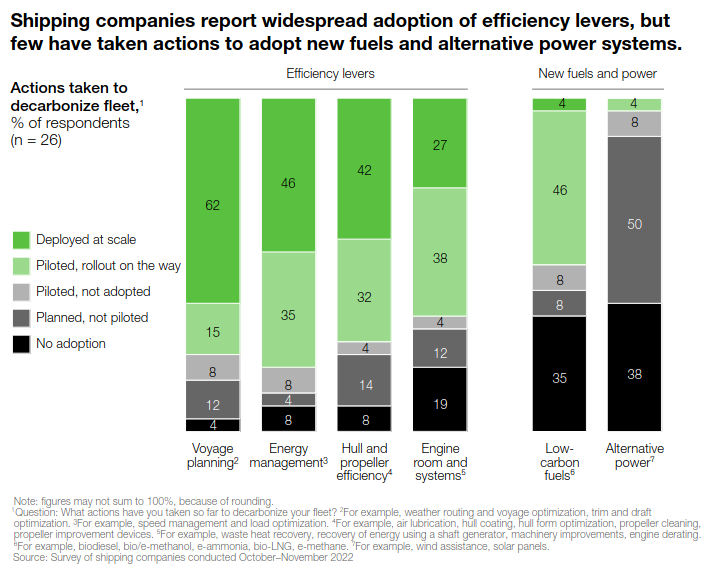

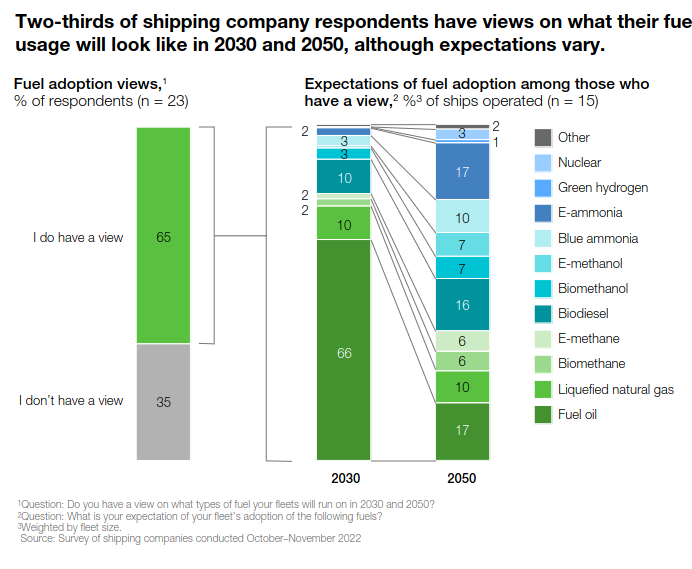

There are more options for fuel (and "efficiencies") as outlined by McKinsey in these graphs with most shippers predicting that they will use at least three different fuels. Which makes the transition even harder to predict.

Marine Road Rail

Marine Road Rail