July 31, 2023

Yellow files for bankruptcy

- Yellow gave Teamsters notice of full shutdown on Sunday.

- 22,000 Teamsters members out of work

- An additional 8,000 workers also out of work.

- Background here.

This shutdown comes as a continued reduction in total employment across the trucking sector. The deregulation of the trucking sector has meant wild swings in employment and continued downward pressure on wages and shipping prices.

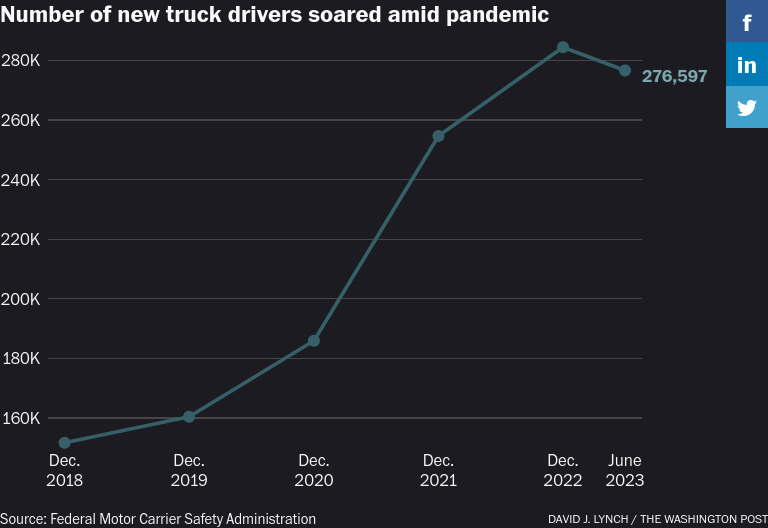

The covid chapter of this story was extreme. At its peak, roughly 8,000 trucking companies entered the market in a single month, compared with the long-term monthly average of about 700, Adamo said. (WSJ)

Nearly 200 Unifor Local 4209 affected.

Unifor Benefits writes:

There are self payment options available either through either the current carrier on the YRC Freight’s policy or GreenShield, on an individual policy conversion basis. These involve a deadline. Members will have 31 days to convert the life insurance amounts and 60 days to convert the health and dental coverage. Disability coverage will cease on the policy termination date.

For members having RRSP/DPSP balances with the current carrier, members will have the option to transfer these balances to their individual financial institution or remain with the current carrier, if those options exist.

Please see below for Green Shield link:

https://mygscadvantage.ca/ha/Quote/AllProducts?mgaid=8915&oid=GPB47&aid=PB4701

Indication of a slight rebound in truck traffic in the USA

There has been a slight increase in shipping traffic. This is unexpected given it is mid summer and slowdowns are expected.

- Increase is mostly due to West Coast Long-haul.

Reasons include:

- inventories are down across the retail sector

- a surprise increase in demand for building supplies

- shipper worries about Western port, UPS and Yellow labour disputes delayed shipping

The increase in demand is not turning around prices, which continue to fall from highs during 2022's whipsaw price increase from pandemic lows.

CPKC Reporting losses because of port strike

CPKC is looking at expanding work in Eastern Canada and Mexico to off-set losses at the Pacific Canada port strike.

The work stoppage by members of the International Longshore and Warehouse Union at Canadian West Coast ports may have cost Canadian Pacific Kansas City $80 million in lost revenue, executives said during the railway’s second-quarter earnings call.

The railway has been deploying a number of “self-help” strategies to drum up additional business once demand recovers, such as ramping up activity through the Port of St. John in eastern Canada to offset softer macroeconomic demand occurring in the international intermodal space, according to Brooks. (FW)

Revenue Call

Problematic comments from the CPKC

- CPKC executives state that the railway is "carrying surplus head count".

CPKC’s Q2 2023 financial results

-

Revenues second quarter: CA$3.2 billion (US$2.4 billion)

- up 44% year over year

- This was because of the increased revenue from the merged Kansas City Southern rail company.

-

Several one-time expense items (combined $45 million)

- a litigation settlement

- an expensive derailment

- Net income: $1.3 billion ($1.42 per diluted share), for the second quarter of 2023, compared with $765 million, or 82 cents per diluted share, for the second quarter of 2022.

- Expenses: $2.2 billion ($1.3 billion y/y)

- Volumes: down by 5% in the second quarter

- Head count was up 6%.

Martin Imbleau appointed CEO of VIA Rail HFR

- https://www.canada.ca/en/transport-canada/news/2023/07/minister-of-transport-welcomes-the-appointment-of-the-inaugural-chief-executive-officer-of-via-hfr-inc.html

Previous positions:

- Port of Montreal: CEO

- Energir: corporate development and renewable energy operations

- Hydro-Québec: corporate strategies and business development.

Marine Road Rail

Marine Road Rail