July 27, 2023

CN Earnings call

Highlights:

-

Expects earnings will remain lower through 2023.

- Profit margins under pressure.

- Flat to slightly negative growth adjusted earnings per share.

- Lower grain volumes

- slower growth in consumer demand for goods traveling by rail

- Volumes for petroleum and chemicals are also "pretty flat"

- Expects earnings/revenue will be "more positive" in 2024.

- Short-haul trucking seeing competition (loose market)

Specifics:

- Second-quarter 2023 adjusted net income of CA$1.17 billion (US$886 million)

- $1.76 per adjusted diluted earnings per share

- This compares with CA$1.33 billion, or $1.93 per adjusted diluted earnings per share, for the second quarter of 2022.

- CN’s revenues were CA$4.06 billion in the second quarter of 2023, down 7% y/y

- CN expects Canadian grain volumes to be in the mid-60 million ton range for the 2023-2024 crop year, down from 74 million tons in 2022-2023.

- Lumber shipments is also in growth territory.

- Trucking competition in: Toronto-Montreal and Toronto-Moncton routes.

- Removed leased center beams from circulation.

- Some losses off-set by cheap Canadian dollar.

- CN is expected to slow down hiring through the end of the year.

- Hiring continues in "hard to hire" locations in Western Canada.

- Main focus is "advanced locomotive training"

Investment plans:

- CN to work with Wabtec to modernize 60 locomotives

- Modifying 60 pre-owned Dash 9 locomotives.

- Moving these to AC-powered traction instead of DC.

- These locomotives are already higher tech with Trip Optimizer and LOCOTROL Distributed Power.

- Increased fuel efficiency by 18%.

- CN will (with the above) have 110 modernized locomotives in their fleet.

- Purpose of "modern" fleet is to reduce emissions by 43% per gross ton mile by 2030 (from 2019)

Graham's Comment on Trucking

I will look deeper for specific numbers, but here is a clarification of the "loose" trucking labour market referred to above:

- There was a pre-pandemic over-hype of automated trucking that drove down demand and interest for truckers.

- The pandemic increased need for truckers (because of a short bump in volume of goods), pulling people into the industry. An industry that only looked to have a very tight labour-market.

- Major supply chain changes in load and carry volumes increased until this year when that demand suddenly reversed.

- Right now is the bottom of the demand cycle for trucking and so we have a double negative impact on volumes happening right now.

- Now there are "too many" operators/driver/trucking companies/trucks compared to demand.

This situation has increased competition on major routes for intermodal trucking.

Part of CN's response to this was the purchase of TransX/H&R to decrease wages for intermodal trucking (especially in refrigerated container freight trucking).

Fuller explanation:

As you all know, this is happening in a very liberalized and unregulated trucking market.

In general, intermodal short-trip trucking volume is aligned with all long-haul cargo shipping volume. Long-haul cargo transport volume is aligned with consumption. There is currently low consumption, low volume, and therefore lower demand for intermodal trucking.

Consumption is way down across the board which means that intermodal trucking is in a rather "loose" labour market. Loose labour markets means downward pressure on shipping rates and therefore downward pressure on our wages.

Add to this the increased costs of trucking because of shifting to expensive technologies, more operators on the edge of bankruptcy but with less long-term overhead than established corporations like CN and huge increases in debt/lease costs, sustained high price of fuel, and general costs of living.

All together you get increased competition between established companies with unions and "start-up" or less unionized companies.

The major routes that we are seeing a collapse in intermodal trucking are the same places we had an opportunistic increase in trucking company starts during the pandemic boom in consumption. Montreal-Toronto and Toronto-Moncton.

This is all happening across North America.

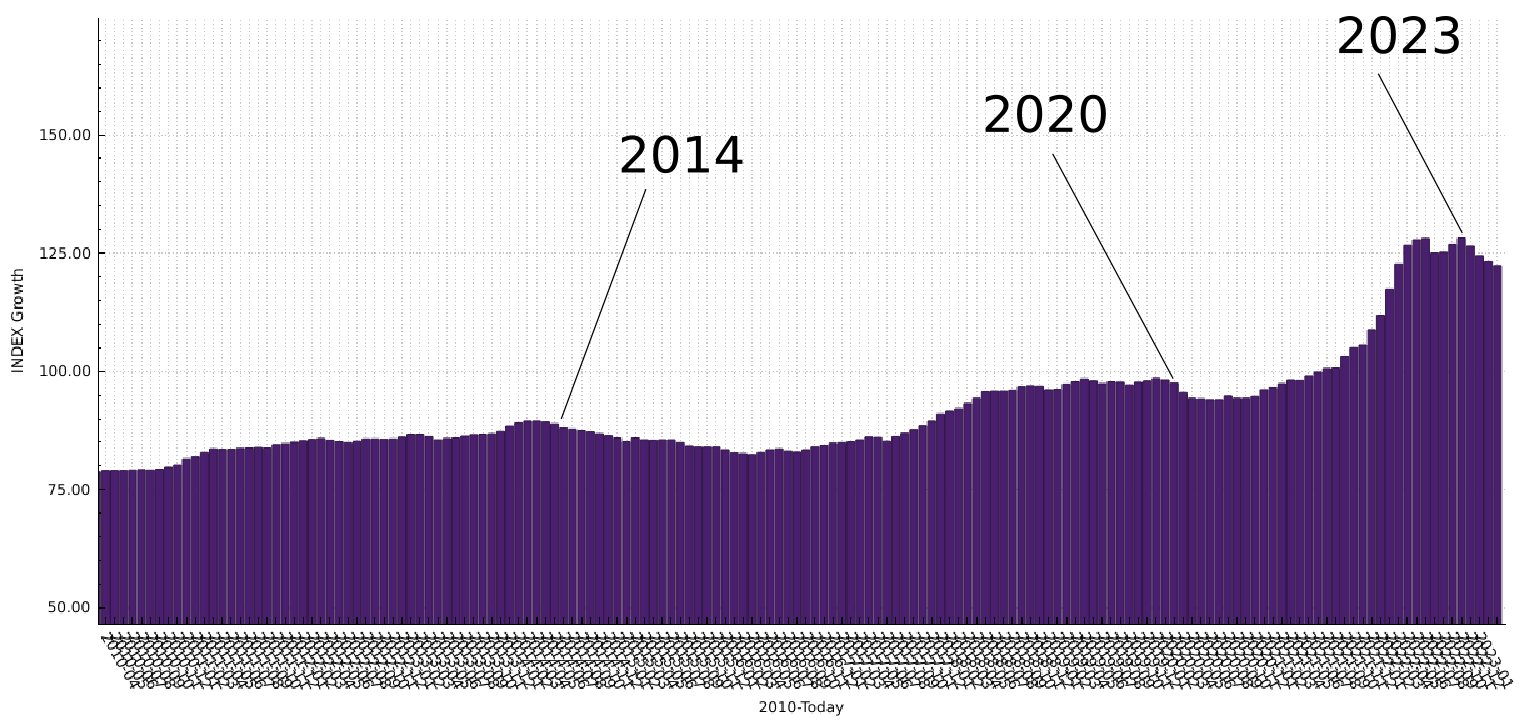

Here is a graph of Trucking growth since 2010.

Marine Road Rail

Marine Road Rail