January 9, 2024

Supply Chains

A few things that will impact investment, energy, and transportation in Canada

- China has banned the export of midstream refinement technology for critical minerals.

- Shipping routes diversion around Africa instead of through the Red Sea/Mediterranean.

- Ongoing problems at the Panama Canal

- Delay in California implementation of regulations for EV for trucking, but implementation on emissions from warehousing continues pressure for shift to zero emission vehicles.

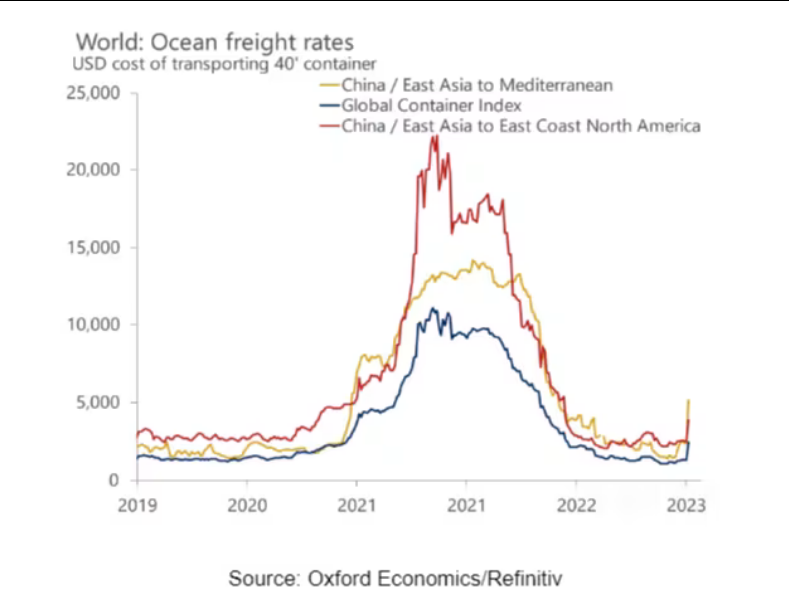

The outcome of most of the above will be increased rates for shipping and another pressure on container access over the "short term", but some shippers are planning for longer. Diverting shipping along longer corridors means supply chains are disrupted for "just in time" goods including food and manufacturing inputs.

- Shanghai-Los Angeles spot rates spike 30%

- The diverted journeys around Africa can take as much as 25% longer than using the Suez Canal

These shifts in supply chain routes is going to have an impact on rail movements. Much was made of the shift to the Atlantic coast for shipping, but the added time to go around Africa and blockages at the Panama Canal may push those routes back to the Pacific Coast.

Shift to zero emission vehicles will drive costs for owner-operators and trucking companies. This, in turn, will increase the adoption of new trucking technology.

The lack of legal blocks on government-pushed investment in new technology around warehouses means there will be a continued reduction in workers needed within warehouse gates. The fastest rate of automation is seen in the warehouse sector which is where much of the competition is focused right now. Automation within the gates is being pushed too with the introduction of autopilot from gate-to-bay.

Investment in electrification of the trucking fleet means that there will be a push to charging stations near/in warehousing. This is likely to be a driving edge of technology adoption.

Recent issues related to theft of charging infrastructure in the US Postal Service could trickle-down to more surveillance of warehouse and trucking workers (if that is even possible).

Trucking jobs in the USA are up towards the end fo the year. That market seems to have stabilized somewhat from the beginning of last year.

Automation in Rail

It is going to be slow arriving, but there are edges of the system that autonomous rail cars will make their entry and expand from. Unlike the limited ability of automated trucking to be a major threat to all truck traffic in North America, rail is technologically easier.

While the technology suffers from the high costs of many automation system and rail is already rather cheap, the ability for smaller regrouping of long trains is an issue for our members. Technology from these new(ish) ideas for automated rail cars will filter down into the major carriers. This, along with electrification (and even hydrogen) will directly impact the skills needed for maintenance, inspection, and the regulations for operations.

For example, moving cars around yards is manual. Interacting with some automated systems while dealing with regular cars will be a health and safety issue.

Car structural integrity and derailment

- New report released by Transport Safety Board of Canada says that a derailment of a CN train in 2019 was the result of structural failure of a "bathtub gondola car".

Visual examination determined that the defects were not recent but had developed over a period of time.

In addition to the notice of inspection on these types of cars outlined by the TSB, we should always raise the question of automated inspection augmenting or replacing humans as a solution when it comes to acquired defects.

While this was somewhat a failure of inspection process, it is unlikely that an automated system would have been better.

Amtrak upgrades

The Long Distance fleet replacement RFP is out:

- Purchasing 125 ALC-42 Long Distance locomotives (Siemens Charger made in the USA), with more than three dozen already in service.

- Investing $28 million for interior upgrades to 400 bi-level Superliner and 49 Viewliner cars. Nearly 200 Superliner cars have been refreshed and are now in revenue service and the Viewliner refresh will begin in 2024.

Amtrak Long Distance ridership grew by more than 12% across the network from Oct. 2022-Sept. 2023 at nearly 3.9 million trips.

Marine Road Rail

Marine Road Rail