December 20, 2023

Seaway and Rail Transport 2023

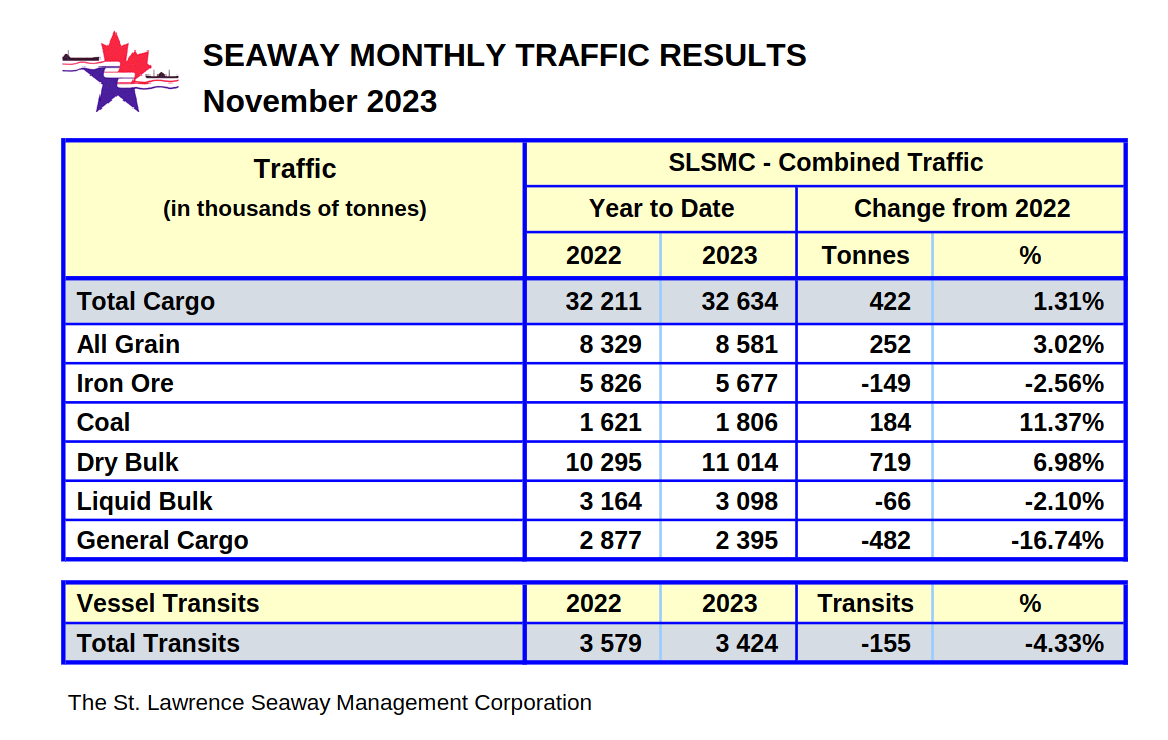

General goods transport was reduced across the Seaway in 2023 compared to 2022. It is unclear if the Unifor Seaway strike was the cause of this year-measure of reduced movement of goods.

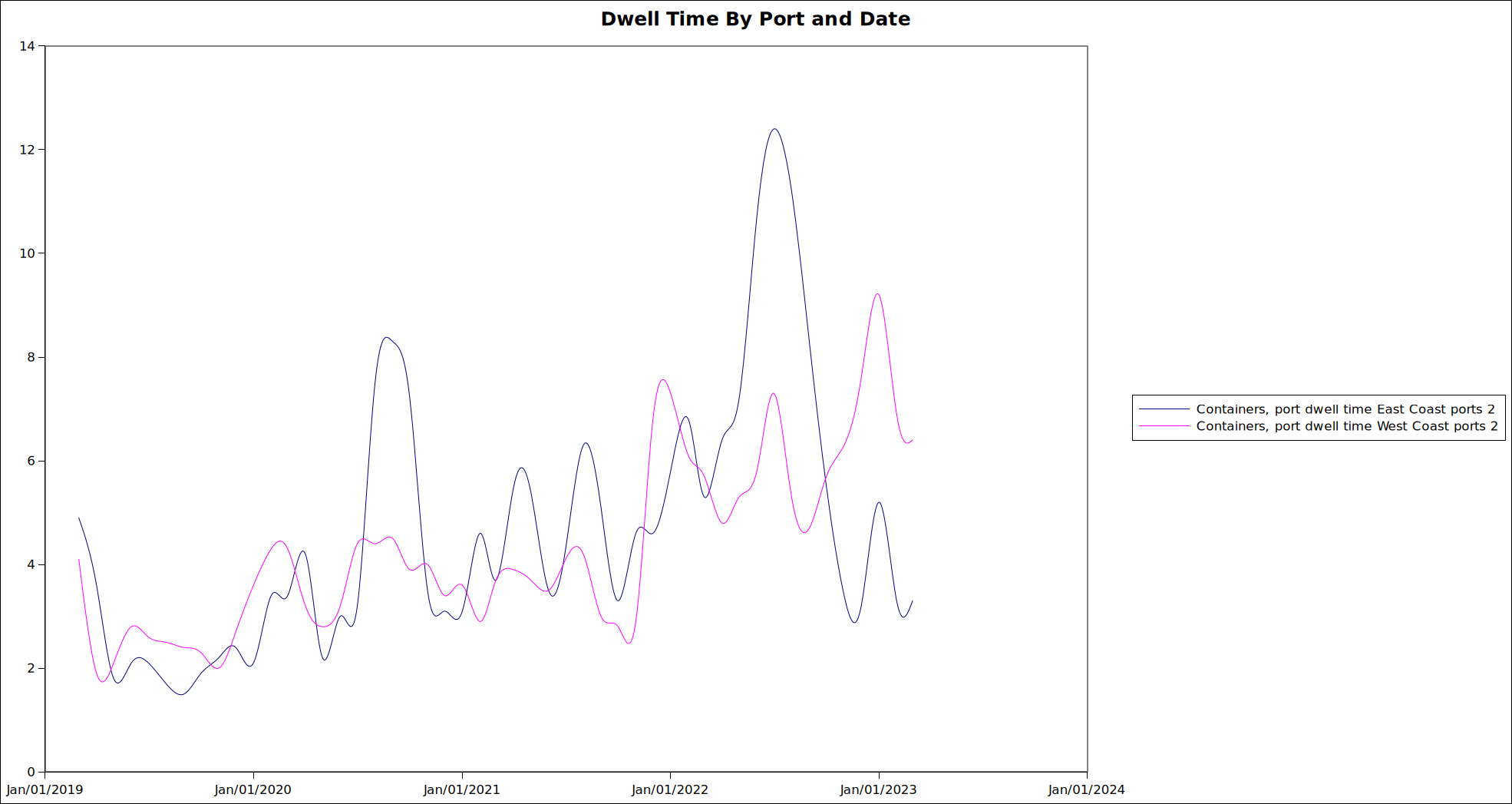

There was significant more fluctuations of goods movement in 2022-2023 across all modes of transport in Canada.

Total 20-foot equivalent was down 26% comparing March 2022 and March 2023 (the latest StatCan data we have). The general global supply chain disruptions of 2022 had not really ended by March of 2023.

Other indicators show that it is likely movement of goods rebalanced as of the end of the year. Price pressures from shipping had eased and spot prices for shipping containers had mediated significantly by December. However, shippers continued to have significant control over rejection rates across the USA and Canada showing that supply of shipping volume was still fairly tight.

ILWU's strike had not started/concluded (June 2023) yet and we are still waiting on details for the impact of that action on goods movement across ports and its impact on shipping rates.

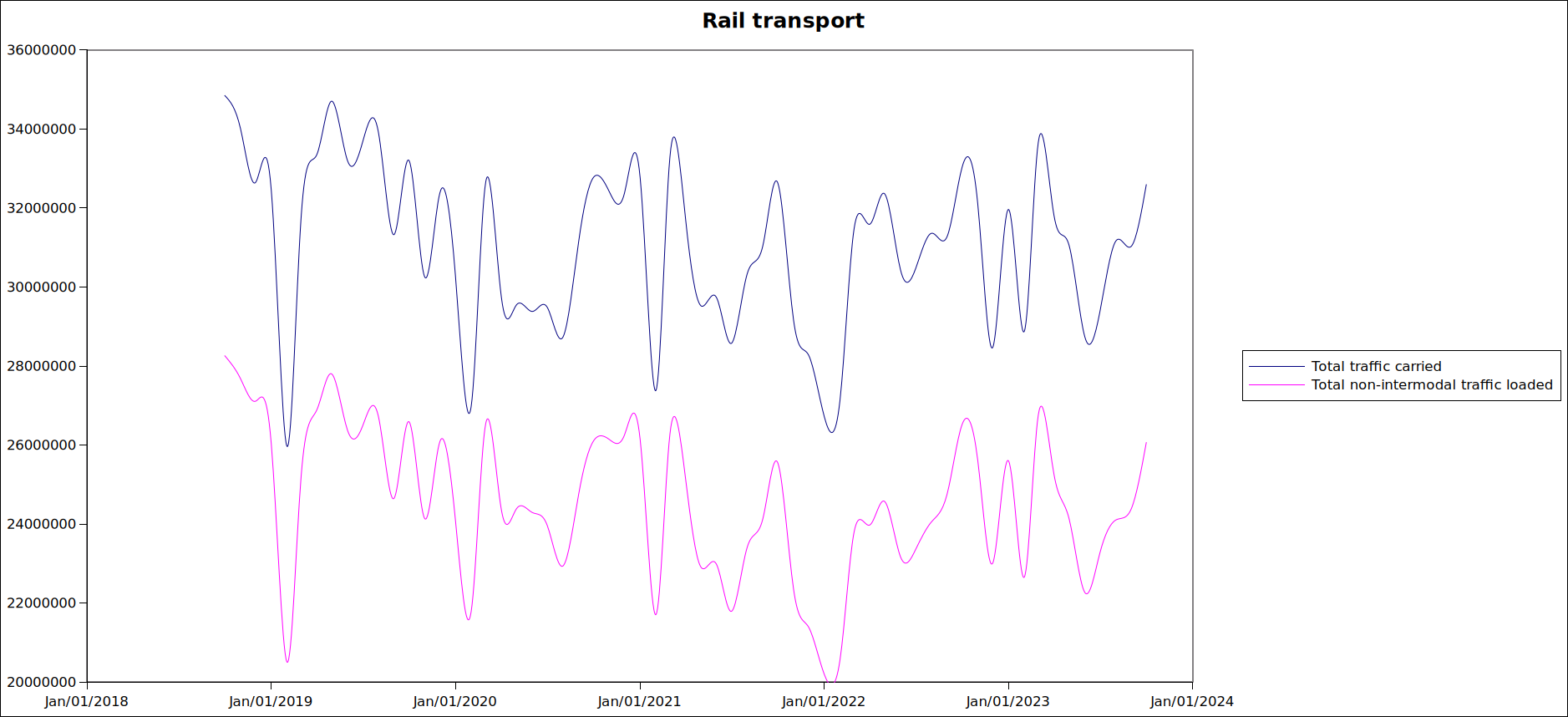

Intermodal transport had a decent year overall and while the mid-year reduction in total transport was deeper than normal trend, it was more likely that the reduction in total global movement of goods we more to blame than strike action.

The largest short-term impacts on rail continue to be extreme weather related and not due to strike action. In 2019, it is the cold weather in February that impact rail movement more than strike action in November. The global supply chain crunch from December 2021 to February 2022 also had a much larger and clearer impact than labour disruptions.

Two issues important to outline in the current Canada supply chain discussions:

- Climate change-related extreme weather event frequency.

- Geopolitical supply chain disruption.

Weather events are the largest threat to stable and functioning supply chains and supply chain security for Canadians. The increased frequency and severity of climate change-related weather events means that marine, rail, and road infrastructure must be upgraded for adaptation/resilience of Canadian freight transport.

Shipping is predicted to shift to the East Coast ports because of geopolitical concerns with trade with China and the Middle East supply routes. The Seaway and intermodal transport to and from those Eastern ports should receive increased investment. How these investments change the importance of the Seayway and the ability of CN/CPKC to move goods and energy products to the North-South corridors and Europe will be of interest to the use of Canadian ports/shippers.

Potential exists for expansion of Seaway traffic of goods, but it is also likely that rail will be used to counter risk of strike action along the Seaway.

CN attempted to do take some Seaway cargo during the Seaway strike by advertising discounts for shippers who wanted to by-pass the Seaway. For this strike it is clear shippers either did not care that the strike was on (since they run the seaway) and could wait for it to be over, or rail did not pose a viable alternative. However, strategies may change in the coming round of bargaining.

The shifting patterns in supply chains also shows why Unifor's marine and rail sectors should coordinate bargaining times and demands.

Coordinated bargaining actions does not necessarily mean concurrent strike actions. Pressure to limit free collective bargaining in the supply chain sectors of the economy are mounting and a real threat under a potential Conservative government. Options put forward by employers include introducing interest arbitration or "essential" services legislation limiting the right to strike.

Building union power in this sector must be done in a way that can pit employers against each other during bargaining. Securing supply chain resiliency is essential to maximizing this tactic and ensuring Canadian supply chain workers face a secure employment future.

The support for supply chain data collection, management, and for aggregate data to be made public should form part of our submission to government asking for public and private investment.

Marine Road Rail

Marine Road Rail