Yellow Bankruptcy

- Unifor press release: Truck drivers told ‘not to report to work’ as YRC Freight Canada files for bankruptcy

Summary

- Yellow trucking is attempting to file for bankruptcy this week. However, as of this note, no filing is public yet.

- All Yellow freight subsidiaries have ceased operations as of noon Sunday, July 31, 2023.

- YRC Freight is the main subsidiary of Yellow dealing with freight in the USA and Canada.

- Canadian branding: YRC Freight Canada. YRC Freight Canada is no longer a separate subsidiary to YRC Freight.

- Two Unifor units affected from Local 4209.

- Affects ~200 Owner Operators and Company Drivers in Canada.

- Teamsters have 22K-30K members in Yellow and some members in Canada: Teamsters Local 91. For YRC Reimer.

- Yellow announced this Friday that it was selling the logistics arm of its company. Before it officially files for bankruptcy.

- Layoffs were announced at corporate head offices and chains placed on gates.

- Company has asked delivery drivers not to bother to pick up invoice cheques from shippers.

- Apollo Global Management, a USA hedge fund and one of the largest creditors to Yellow has been reported to be forming a debtor-in-possession to provide bridge financing through a loan to Yellow.

Additional information

- Yellow was burning $10M a day and only had $100M in cash as of the previous week.

- Yellow looks relatively insolvent at this point: unless it can find financing or limp along and become solvent by selling its profitable logistics arm, it is not liquid.

- The Teamsters have asked the USA government to intervene in the bankruptcy because it involves the Teamsters pension and benefits fund. There does not look to be any response that will save the company offered by the Biden Administration.

Class action filed against Yellow on process of terminations

A class action lawsuit has been filed against Yellow on the way that it has terminated employees. It has been filed in California.

The company needed to provide 60 days notice on layoff (90 days in some states), but did not provide it. There is also the issue of severance.

The class action is in the USA.

A similar situation exists in Canada where under the Canada Labour Code mass layoffs require notice. This was not given to Canadian employees.

Apollo and Debt-in-Possession:

- Bloomberg Article: https://www.bloomberg.com/news/articles/2023-08-01/apollo-leads-deal-to-provide-trucker-yellow-with-bankruptcy-loan?sref=cFA3DGqj

- Apollo is owed most (or, rather, a plurality) of the debt payments Yellow has promised to pay.

- Apollo wants to make sure it is first in line to payments, so it is becoming the debtor-in-possession. It will work with other private lenders whom the company owes money to so that it is able to function as a financial corporation as it is stripped of assets and/or re-organized.

- It is a move to offload the risk of creditors (Apollo) in the case of the bankruptcy process collapsing halfway through because it runs out of money.

Issues that drove the bankruptcy

- Yellow has had huge debt loads for years after expanding and purchasing assets.

- $700m paid to the company as a loan "improperly" under the covid supports from (Trump administration) USA government.

- The company waffled on payments to the pensions and benefits funds.

- Teamsters were in ongoing negotiations and fighting violations of CA wage provisions. A threat of strike was floated.

- A court rejected Yellow's calls for judicial intervention against the strike threatened by the Teamsters.

- The strike threat and public waffling affected contract deals with Yellow putting them even closer to insolvency.

- Yellow tried to get around this by delaying payments to the pension fund.

- Teamsters won the court battle forcing Yellow to pay into the pension fund.

- Bankruptcy process was initiated immediately after this.

- Reports on Yellow state it has over $1.3B in outstanding debt.

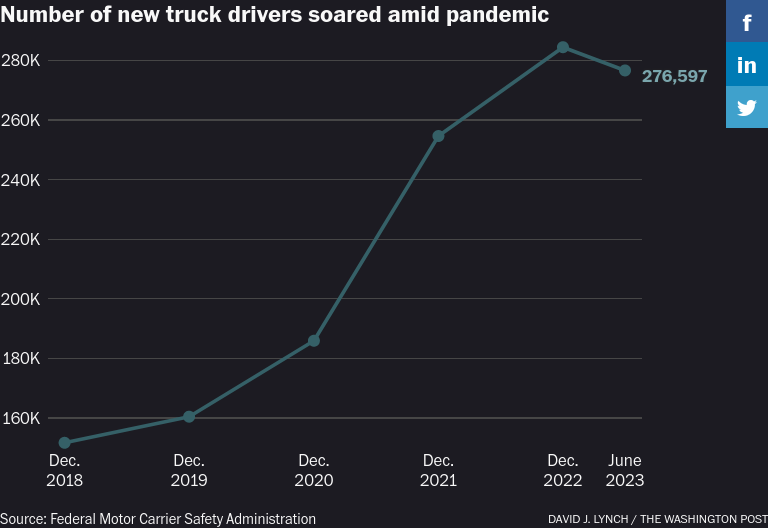

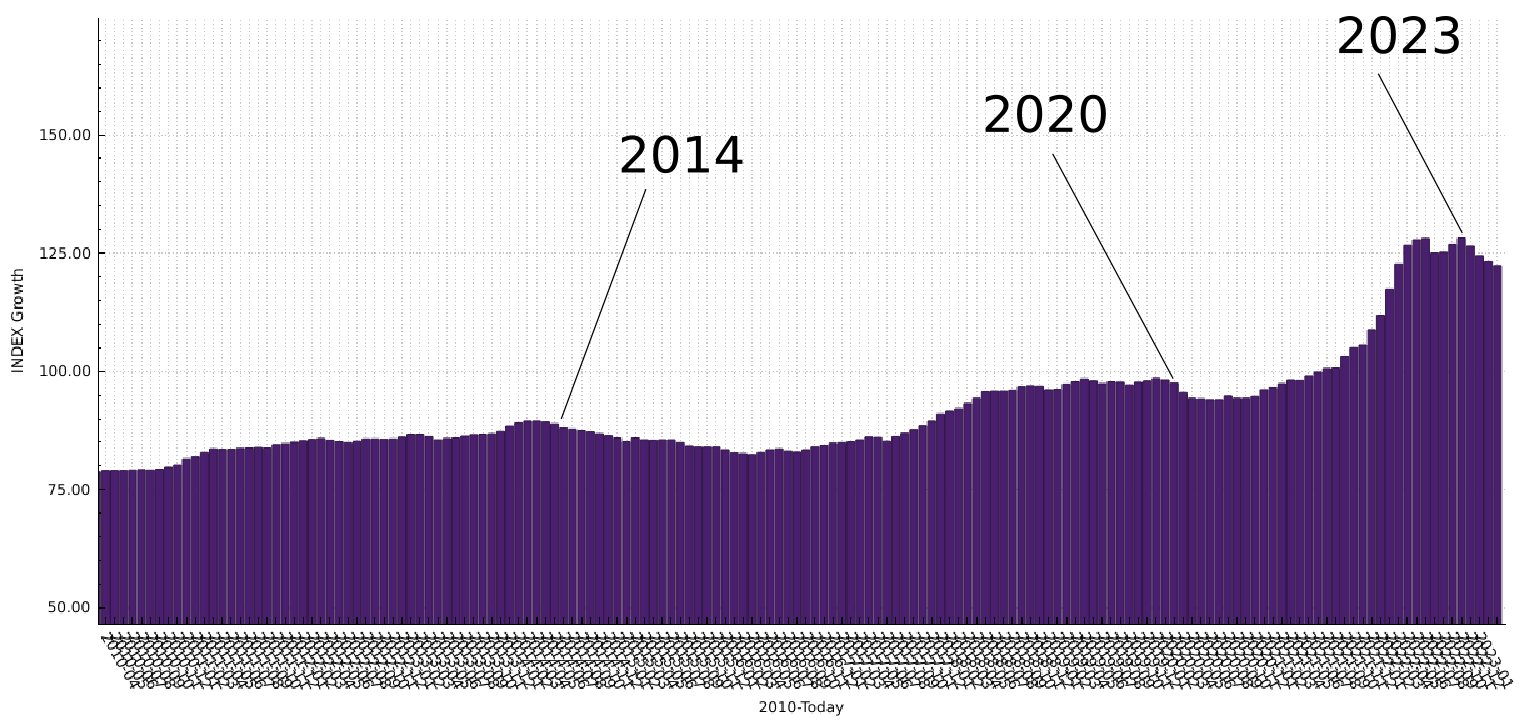

This is happening in the context of many bankruptcies and closing of trucking transport companies in the USA with the decline of transport services needed this year compared to 2021-2022. The fluctuations of demand for transport services has left many companies in the USA wrong footed this summer.

There is a continued reduction in total employment across the trucking sector. The deregulation of the trucking sector has meant wild swings in employment and continued downward pressure on wages and shipping prices.

USA trucking market:

Canada's trucking market (StatCan Index):

The covid chapter of this story was extreme. At its peak, roughly 8,000 trucking companies entered the market in a single month, compared with the long-term monthly average of about 700, Adamo (Ken Adamo, chief of analytics for DAT Freight & Analytics in Akron) said. (WSJ)

Approximately 200 Unifor Local 4209 members affected

- Unifor represents Owner Operators and Company Drivers across multiple provinces.

- Operations have been ended and actions by the company indicate that workers have been laid-off from Canadian operations.

- Uncertainty remains for Unifor members.

- Communication with the company is only through a few employees left dealing with payroll. These employees are attempting to get everyone paid.

Owner Operator concerns:

- Electronic Log Devices: $704.78 to be reimbursed to drivers when returned to company.

- Truck Holdback Fund: of $3000 owed to members.

- Payment of earnings for all of July 2023 not accounted for.

- Yellow is self-insured: truck accident repairs, write offs, and payout are owing.

- Decals on trucks: cannot be returned to company property

- Benefit plan: prescription drug, dental has been ended.

- Log sheets: need them returned to claim for GST and for taxes

- Access to terminals: they are locked and cannot retrieve personal belongings.

Company Driver concerns:

- Unifor members did not receive any notifications of a lay-off like Teamsters.

- Payment of wages to July 31st for all work performed

- Benefits plan has been ended.

- Log sheets: need them returned to claim for GST and for taxes

- Concerns around contracting-out remaining freight

- Drivers want official Records Of Employment

- Access to terminals: they are locked and cannot retrieve personal belongings.

- Still questions of continued STD and LTD coverage.

Unifor Benefits writes:

There are self payment options available either through either the current carrier on the YRC Freight’s policy or GreenShield, on an individual policy conversion basis. These involve a deadline. Members will have 31 days to convert the life insurance amounts and 60 days to convert the health and dental coverage. Disability coverage will cease on the policy termination date.

For members having RRSP/DPSP balances with the current carrier, members will have the option to transfer these balances to their individual financial institution or remain with the current carrier, if those options exist.

Please see below for Green Shield link:

https://mygscadvantage.ca/ha/Quote/AllProducts?mgaid=8915&oid=GPB47&aid=PB4701

Other Less-Than-Truckload companies represented by Unifor

- Kindersley: kindersleytransport.com

- Atlantis: atlantisairlink.com

- Consolidated FastFrate Transport

- Morrice: morricetransportation.com/services/ (Ontario only)

-

Many of the TFI/Trans Force/TForce family of companies:

- Vitran

- Loomis

- TForce Final Mile

- ICS Courier

- Cummins

Marine Road Rail

Marine Road Rail