Lafarge

Introduction

Lafarge is owned by Holcim Group, one of the world's largest cement companies. Holcim is undergoing a significant transformation as it prepares to spin off all its North American businesses into a publicly traded company in 2025.

This move aims to unlock higher shareholder valuations and capitalize on the growing demand for cement in the USA, driven by public infrastructure projects.

Company Background

Lafarge was a French multinational, now owned by Holcim Group, a Swiss multinational.

- Holcim, previously known as LafargeHolcim.

- New CEO: Jan Jenisch

- Operates in 60 countries with 60,000 employees.

-

European listing and past association with an ISIS pay-off have both negatively impacted its valuation.

- European companies have valuations that grow slower that American listed companies.

- The name was tarnished over connection with doing business with ISIS controlled areas.

- North American spin-off to be overseen by Jan Jenisch and completed in 2025.

Strategic financial engineering

Seeking higher valuations through the spin-off, aiming to emulate the success of competitor CRH.

Holcin's business side in the USA represents only 40% of total operations but is predicted to be valued in the financial markets at 3/4 of the company's current value, if spun-off and listed in the USA.

Holcin's new corporate focus is

- expansion through acquisitions and mergers.

- emphasis on low-carbon concrete, aligning with broader sustainability goals.

Holcin's valuation has grown considerably since announcing the spin-of. This is even the case as its net income is flat, and revenues have declined due to cost-cutting measures.

- Cash flow is negative due to acquisitions but returning to 2022 levels.

- Dividend yield is 4.41% with a 5-year growth rate of 6.96%.

- 2023 dividend was 2.80 CHF, a 12% increase over 2022.

- CEO Jan Jenisch received 5.88M CHF in compensation for 2023.

Concerns

A financial engineering approach to shareholder valuation raises concerns about potential cost-cutting measures impacting workers.

- 2025 is projected to be peak growth for the U.S. cement industry, driven by public infrastructure spending.

- The spin-off with merger and acquisitions may present an opportunity for Lafarge to capitalize on this growth and achieve higher valuations. However, real value addition is unlikely.

Lafarge drivers

- Historically, drivers were well paid compared to competitors.

- Drivers are paid per hour and by kilometer driven, excluding loading time.

- Rate increases have not kept pace with industry or inflation.

- Each load is estimated at a value of $60,000.

- Dry cement is the main cargo.

- Primarily operate B-trains, with most deliveries to Newfoundland via Marine Atlantic.

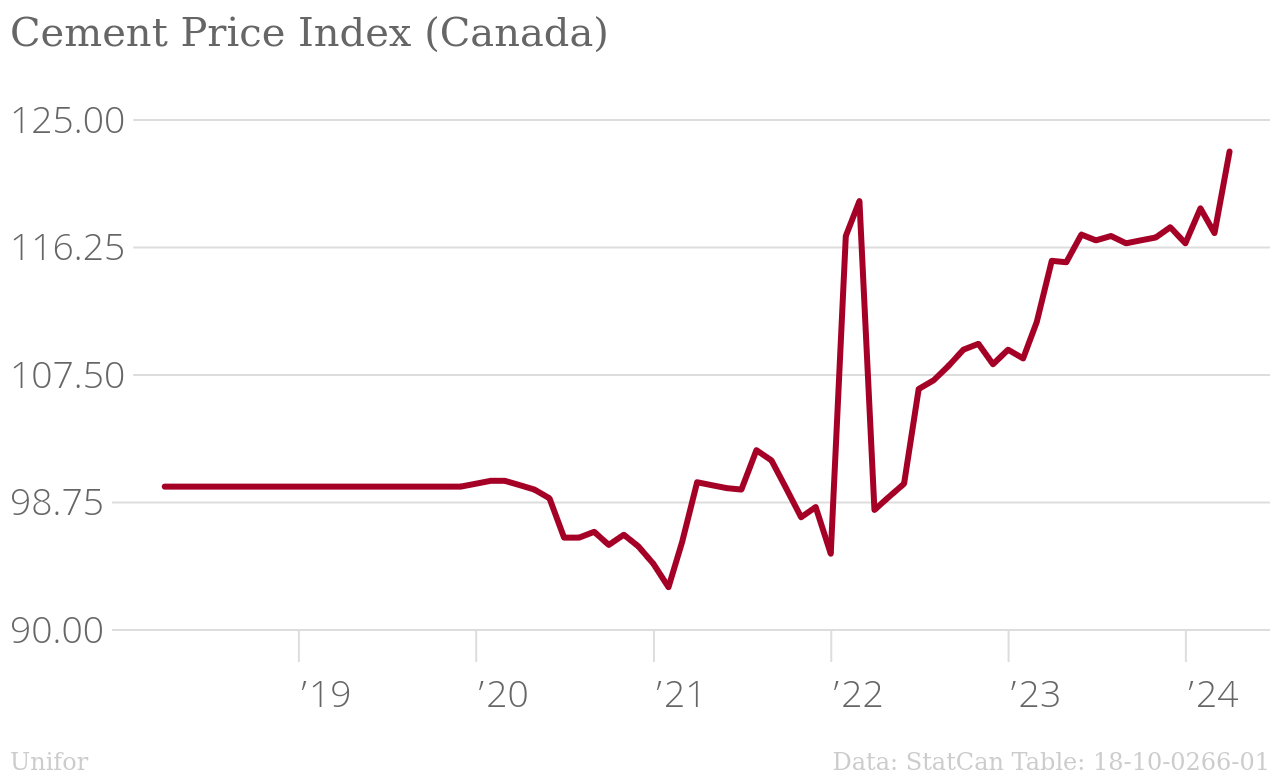

Cement price index

Dry cement price index shows large increases in prices since 2020. Data pre-2020 is likely incorrect/not measured properly given the lack of change.

- Cement and concrete manufacturing(StatCan)

- GDP of industries by month.

- Industrial product Daily.

- Canadian industry summary (ISED)

- StatCan Cement survey was cancelled in 2018. The survey used to measure production and shipment information.

Marine Road Rail

Marine Road Rail