CPKC and CEO Keith Creel

CPKC President and CEO: Keith Creel

Mr. Creel holds a Bachelor of Science in marketing from Jacksonville State University and completed the Advanced Management Program at Harvard Business School. Mr. Creel has a military background as a commissioned officer in the U.S. Army, during which time he served in the Persian Gulf War in Saudi Arabia. (CPKC bio page)

Career

- Started as an Operations Manager (intermodal ramp manager) at Burlington Northern Railroad (Alabama) then Illinois Central Railway which merged with CN.

- Manager of Michigan Zone at CN.

- Moved to Canada in 2002.

- Various roles at CN: Prairie Division, CN Western, Senior CN Eastern Region.

- Chief Operations Officer (COO) at CN in 2010.

- Moved to COO at CP in 2013

- Replaced Hunter Harrison as CEO in January, 2017.

- Claims to have improved relations with the workforce after initial cuts from precision railroading.

- One of the highest-paid (if not the highest paid) CEOs in Canada in 2023 ($20 million), including base salary of $1.8 million.

Leadership style

- Emphasis on "precision railroading": increasing productivity per locomotive, reducing dwell time, longer trains, faster average speed.

- Focusing on "precision railroading" with a "human face".

- Implementation of logistics and digitization to track and plan the supply chain.

- Has overseen the implementation of technology to replace workers and reduce workforce numbers.

- Union issues result from CP workforce reduction pre-merger: 16,000 in 2012 to under 12,000 in 2016-2021.

CPKC: Canadian Pacific Kansas City

Formation and Overview

- Canadian Pacific Rail and Kansas City Southern merged in April 2023.

- Isabelle Courville, Chair of the Board. Degrees in engineering and civil law from Quebec.

- Combined track: 32,000km (same as CN).

- Combined employees (including contractors and consultants) 19,927 (12,754 for CPR before merger)

-

Unionized:

-

Canada: 7,200 unionized active employee (9 bargaining units)

- Unifor represents 1,200 locomotive and car inspection and maintenance workers in Unifor Local 101R.

- Combined: CPKC is 74% unionized (75 active bargaining units)

-

- Owns the former Montreal, Maine, Atlantic Railway (from Lac Megantic disaster), opening up Eastern routes.

- Focus of expanding to Eastern Canada, port of Saint John.

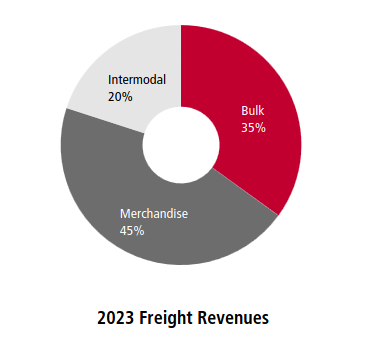

- Rail freight is diverse, with most bulk being grain and metallurgic coal.

- Merchandise includes chemical and plastics transportation (42%) and automotive (17% of merchandise, 8% of total)

- Automotive: vehicles originating from Canadian production facilities in Ontario, the U.S., Mexico, and overseas through Port of Vancouver.

Risks to revenue

Similar to CN, CPKC has an active campaign calling for the limiting strike actions through:

- amending the process federal labour negotiations to include mandatory interest arbitration.

- working with the rail employers association (Railway Association of Canada) to push for employer friendly legislation

- focusing on "Critical Infrastructure" and relating strike threats to high inflation.

- working through FETCO to attack anti-scab legislation

- working with international employer at the ILO attacking the right to strike.

- lobbying every member of Parliament on the issue.

The risks to revenue generation are vast. The focus on the labour relations regime in Canada. The company is in public overly focused on Bill C-58 anti-scab when examining the broad issues of resilience across its network.

- Climate change (physical incidents and reputation related)

- Cybersecurity

- Technology access/maintenance

- Transport regulatory changes in three countries

- Climate related regulatory changes

- Regulatory and government agency investment demands

- Global supply chain disruptions (war, climate, geopolitics, trade)

- Other connecting company failures

- Financial and capital market shifts

- Global health conditions

- Political risks of operating in three countries with shifting political situations

- Supply chain costs resulting from global shifts in supply

- Accident costs

- Availability of skilled workers

- Fuel prices

- Competition with other rail companies and transport alternatives

Resilience of the rail transport infrastructure, necessary regulatory regimes shifting from road to rail for long-distance transport, and investments in new/shifting extractive and manufacturing industries in Canada will have more of an impact on revenue for CPKC than any short-term, known quantity disruptions such as strikes.

| Government Institution | Funding Received in Last Financial Year |

|---|---|

| Emissions Reduction Alberta | $2,050,301.21 |

| Transport Canada (TC) | $9,804,383.29 |

Canada Pacific Railway (CP)

- CPR operates as a subsidiary of CPKC holding company, but integration of logistics is the goal.

- ~20,100 kilometres

- Canada wide and into northern USA

Kansas City Southern (KCS)

- KCS is now a subsidiary of CPKC

- KCS: 6,412km of track

- Mexico group: 5,335km from privatization of Ferrocarriles Nacionales de Mexico (FNM) in 2001.

- Texas Mexican Railway

- Panama Canal Railway (50%)

- Ferrovalle in Mexico City (25%)

Technology

- CPKC tech (in-house automated inspection, hydrogen fuel cell trains) sold to other rail companies.

- Looking for biofuels in the short term to reduce emissions.

Full technology reviews found here:

Recent investor relations

Financial performance

- Claims of BC port strike costs of -$80 million in revenue.

- Freight volumes down 5% in Q2 2023.

- Q1 2024 with small (1%) increases in Revenue Tone-Miles (RTMs).

- CPKC claims to be North America's safest railway (likely size dependent before merger, but also related to culture).

- Revenue up significantly from previous years due to the merger.

There is difficulty comparing between pre and post merger on performance. KCS is a different rail road company to CP. Total injury rate is up because of the merger with KCS. CPKC is the only rail road for continuous trade between Mexico and Canada through the USA on the same brand.

CPKC is a significantly larger railroad company than the previous stand-alone CPR. The impact will be diverse. Larger and more capable, but operating in three different national state jurisdictions.

Workforce

- Headcount up 1% in 2023.

- Comments that the company is carrying "surplus headcount" even with increased revenue.

Analysis

Profit growth has come with investment in digitization and modernization of logistical programs to drive productivity. Investment in capital to replace workers to minimum staffing levels with current technology has likely come to an end for marginal return on this kind of investment and management practice known as precision railroading. The limits to this kind of investment are the balance between interest rates, cost of new technology, and per-worker total compensation even if that worker can be replaced with some technology.

The limited room for profit growth through automation has shifted focus on downward pressure on wages within the current tighter than normal labour market.

CPKC will now focus on sustaining productivity gains and finding niche area new technologies to automate jobs and smaller reductions in workforce.

Growth in net revenue must come from increased freight revenue and competition on per-unit delivery cost.

CPKC needs to be competitive on green tech transition.

Opportunities exist in controlling their trucking (contracted FastFrate trucking terminals), last mile, ports, cross-border trade, new destinations, northern route expansion, and chemical products.

Unifor represents some FastFrate trucking (provincially regulated) and organizing is looking at expanding our footprint.

CPKC grievances focus on replacement of inspection workers with automation and aggressive discipline processes using strict reading of policies by employer.

Rail accidents in Canada

For all Class 1 rail:

- Small decrease in 2023 from 2022.

- Increase in accidents involving "movements exceeding limits of authority."

- Freight trains account for 35% of rolling stock accidents. 61% of accidents are the other part of trains on tracks.

- 44% are non-main-track derailments (yard).

- Main track derailments unchanged over 10 years (6% of accidents).

- Fatalities: 67 in 2023, 1 worker fatality, 3 worker serious injuries (average fatality rate is 2-3 workers per year across Canadian rail.)

- 9 main track collisions, no deaths or release of dangerous goods.

- Equipment failure: 24% of accidents.

- Track-related factors: 43% of accidents.

- Most public accidents occur at automated crossings.

Previous analysis of rail accidents can be found here.

Precision Railroading

- emerged in the mid-2010s as a management philosophy aiming to optimize railway efficiency and profitability.

Main goals:

- Scheduled operations: fixed schedules for train movements.

- Asset optimization: reducing dwell time, and increasing train lengths.

- Reduced workforce: workforce reductions, achieved through attrition, automation, and operational changes.

- Centralized control: shifting decision-making from local yards to centralized operations centers.

Canadian Context:

Canadian Pacific (CP) pioneered precision railroading under CEO Hunter Harrison in Canada. Canadian National (CN) followed suit and Transport Canada's regulatory framework has allowed/promoted precision railroading with a main focus on safety oversight rather than regulation.

Actual impact

- Service reliability: The goal is to improve profits through service consistency, however there is data showing that it is similar to "just in time" operations. Reduced operational flexibility leads reduce resiliency during peak demand or disruptions in the supply chain.

- Infrastructure investment: focus on automation and worker reduction reduce investment in infrastructure, undermining climate change related weather resiliency.

- Safety regulation: Transport Canada focus on safety standards, resulting fatigue management, track maintenance, and hazardous materials safety.

- Climate: fuel efficiency is essential as there is potential for higher emissions from longer trains and higher speeds.

The main issues are with resilience of the system and finding operational flexibility to handle disruptions and having enough workers to respond to issues.

Marine Road Rail

Marine Road Rail