CNTL

Wage comparisons

This from CNTL's own job posting:

Type: Full Time - Single - O/O

- Salary: $100,000 - $160,000 per year

- Fuel Subsidy Program: 37.7 cents per litre, equivalent value of over $65,000

Other:

- Competitive, reliable, twice-monthly pay

- Steady work with plenty of miles

- Intermodal freight available 7 days a week

- Fuel Subsidy Program: pay only 37.7 cents per litre

- The value of the Fuel Subsidy Program is over $65,000/year on average

- Up to $2000/year in fuel and safety bonuses

- Be home most nights (layovers are rare)

- Paid wait time at customers, terminals, and ports

- Permitting and plating paid

- Border fees and tolls paid

- Group Insurance (optional)

- Tire Purchase Program

- Cab and Engine Heater Purchase Program

- 24/7 road repairs paid for CN equipment breakdown

- On-the-job training

- 24/7 dispatching

- State-of-the-art technology providing Owner Operator support

Background data

A review of some of the wage adjustments and inflation information.

Statistics Canada outlines labour forced data across union and non-union workers in grouped industries. Here are the average wage rates and their growth compared to inflation since 2021.

| Segment | $/hr or % |

|---|---|

| Canada average (trades/transport) 2023 | $31.82 |

| Canada average (trades/transport) 2022 | $30.41 |

| Canada average (trades/transport) 2021 | $29.12 |

| Wage growth 2022-2023 | 4.6% |

| Wage growth 2021-2022 | 4.4% |

| CPI 2021-2023 | 10.9% |

| Private sector Wage Settlement ave 2023 | 3.6%/a (3a) |

| Private sector CAs settled 2023 | 11 (30K) |

| Private sector CA year 1 settlement | 4.4% |

| Public sector Wage Settlments ave 2023 | 3.9%/a (3a) |

| Public sector CAs settled 2023 | 8 (25K) |

| Public sector CA year 1 settlement | 4.8% |

Canada Transportation 11 29,604 34.2 4.4 3.6 8 24,942

CNTL Owner-Operator Rates - Revised January 1, 2023

| Terminal | Rate Plan | Fuel | Wait Rate | Shunt Rate | Short Haul | Long Haul | Weight Prem | OLM's | HW Freetime Cutoff | Short/Long HW Cutoff | Rec Trk |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BRAINT | 32 | $0.403 | $39.00 | $39.00 | 1.568 | 1.568 | - | $39.18 | 70 miles | 200 miles | $1.478 ($1.678 Team) |

| CALLOG | 85 | $0.322 | $38.00 | $35.00 | 1.467 | 1.566 | - | $30.31 | 70 miles | 440 miles | - |

| EDMINT | 46 | $0.322 | $38.00 | $35.00 | 1.494 | 1.566 | - | $30.31 | 104 miles | 440 miles | - |

| HALINT | 48 | $0.350 | $34.00 | $33.00 | 1.540 | 1.540 | - | $30.31 | 70 miles | 200 miles | - |

| MONINT | 49 | $0.360 | $34.00 | $33.00 | 1.540 | 1.540 | - | $30.31 | 70 miles | 200 miles | - |

| SASINT | 12 | $0.407 | $37.00 | $35.00 | 1.513 | 1.449 | $0.10 | $30.31 | 70 miles | 200 miles | - |

| REGINT | 38 | $0.407 | $37.00 | $35.00 | 1.513 | 1.449 | $0.10 | $30.31 | 70 miles | 200 miles | - |

| SYMING | 14 | $0.355 | $37.00 | $35.00 | 1.473 | 1.408 | $0.10 | $30.31 | 70 miles | 200 miles | - |

| TASCHE | 50 | $0.377 | $38.00 | $37.00 | 1.513 | 1.513 | - | $30.31 | 70 miles | 200 miles | - |

| VANINT | 47 | $0.361 | $42.00 | $39.00 | 1.594 | 1.594 | - | $30.31 | 70 miles | 200 miles | - |

| PRIGEO | 70 | $0.322 | $38.00 | $35.00 | 1.467 | 1.566 | - | $30.31 | 70 miles | 440 miles | - |

Comparator wage estimates for 2023

Wage rates for Owner Operators/drivers adjusted for average negotiated and settled wage growth in Canada as outlined above. The average and highest wage rates is the band of wage rates that unionized workers generally exist in.

These are standardized wage rates for truck drivers and comparable salary expectations for Owner Operators across the industry. The right two columns represent an estimate of what are likely to be the highest achieved wage rates given the settlements and wage adjustments we have data for. These include union and non-union wage gains.

| Community/Area | 2021 Ave $/hr | 2021 Highest $/hr | 2023 Ave | 2023 High |

|---|---|---|---|---|

| Canada (Trucking O/O) | 24 | 33.72 | 26.21 | 36.82 |

| Nunavut | 28 | 36 | 30.58 | 39.31 |

| Northwest Territories | 30 | 35 | 32.76 | 38.22 |

| Yukon Territory | 30.9 | 35 | 33.74 | 38.22 |

| British Columbia | 27 | 38 | 29.48 | 41.50 |

| Alberta | 28 | 37.45 | 30.58 | 40.90 |

| Saskatchewan | 25 | 32.5 | 27.30 | 35.49 |

| Manitoba | 22 | 31 | 24.02 | 33.85 |

| Ontario | 24 | 32.24 | 26.21 | 35.21 |

| Quebec | 22.08 | 30 | 24.11 | 32.76 |

| New Brunswick | 19.88 | 26.25 | 21.71 | 28.67 |

| Nova Scotia | 20.5 | 28.85 | 22.39 | 31.50 |

| Prince Edward Island | 19.55 | 28.5 | 21.35 | 31.12 |

| Newfoundland and Labrador | 22 | 34.38 | 24.02 | 37.54 |

| Toronto Region | 24.36 | 33.22 | 26.60 | 36.28 |

| Vancouver | 27 | 38.46 | 29.48 | 42.00 |

| Calgary Region | 27.01 | 35.7 | 29.50 | 38.99 |

| Edmonton Region | 27.24 | 33.65 | 29.75 | 36.75 |

| Winnipeg Region | 21.66 | 31 | 23.65 | 33.85 |

| Regina–Moose Mountain Region | 25 | 34.19 | 27.30 | 37.34 |

| Saskatoon–Biggar Region | 25 | 30.91 | 27.30 | 33.75 |

| Montréal Region | 20 | 31.75 | 21.84 | 34.67 |

| Moncton–Richibucto Region | 20 | 26.44 | 21.84 | 28.87 |

| Halifax Region | 20 | 32 | 21.84 | 34.94 |

CNTL Company information

- 1400 trucks network-wide

- more than 1,050 owner operators

- fleet of 8,000 chassis

- fleet of 8,000 containers

- 20ft and 40ft container

- 23 intermodal terminals across North America

- Rail connections to 3 coasts and 7 major ports

- 5 logistics parks in Canada and the U.S.

Public Finances

Highlights:

-

Expects earnings will remain lower through 2023.

- Profit margins under pressure.

- Flat to slightly negative growth adjusted earnings per share.

- Lower grain volumes

- slower growth in consumer demand for goods traveling by rail

- Volumes for petroleum and chemicals are also "pretty flat"

- Expects earnings/revenue will be "more positive" in 2024.

- Short-haul trucking seeing competition (loose market)

Specifics:

- Second-quarter 2023 adjusted net income of CA$1.17 billion (US$886 million)

- $1.76 per adjusted diluted earnings per share

- This compares with CA$1.33 billion, or $1.93 per adjusted diluted earnings per share, for the second quarter of 2022.

- CN’s revenues were CA$4.06 billion in the second quarter of 2023, down 7% y/y

- CN expects Canadian grain volumes to be in the mid-60 million ton range for the 2023-2024 crop year, down from 74 million tons in 2022-2023.

- Lumber shipments is also in growth territory.

- Trucking competition in: Toronto-Montreal and Toronto-Moncton routes.

- Removed leased center beams from circulation.

- Some losses off-set by cheap Canadian dollar.

- CN continues to expect flat to slightly negative year-over-year growth in adjusted diluted EPS in 2023.

- CN reiterates its longer-term financial perspective and continues to target compounded annual diluted EPS growth in the range of 10%-15% over the 2024-2026 period driven by growing volumes more than the economy, pricing above rail inflation and incrementally improving efficiency, all of which assumes a supportive economy.

2023 financial outlook

- Expecting to deliver flat to slightly negative adjusted diluted EPS (1)(2) growth over 2022

- Continuing to reward long-term shareholders with 8% growth in dividend for 2023 and executing on our 2023-2024 share repurchase program, with an increased budget now in the range of $4.5B.

- For the three and nine months ended September 30, 2023, the Company's net income was $1,108 million.

- Train length of 7,927 (feet) for the third quarter of 2023, a decrease of 3% and 7,870 (feet) for the first nine months of 2023, a decrease of 5%.

- Revenue ton miles (RTMs) of 55,640 (millions) for the third quarter of 2023, a decrease of 5% and 171,478 (millions) for the first nine months of 2023, a decrease of 2%.

| 9 months 2023 | 9 months 2022 | |

|---|---|---|

| Carloads (thousands) | 4,048 | 4,289 |

Terminals

| Terminal | Address | Hours of Operation |

| Brampton (Toronto), ON Port Code: 495 Sub. Code: 3037 | Airport Road & Intermodal Drive 76 Intermodal Drive Brampton, ON L6T 5K1 (Office Address) 55 Devon Road Brampton, ON L6T 5B6 | Mon - Sun: 24 hours daily |

| Calgary Logistics Park, AB Port Code: 701 Sub. Code: 5426 | 250129 Logistics Parkway Range Road 283 Rocky View County, AB T1Z 0A8 (Office Address) 250050 Lantz Way Rocky View County, AB T1Z 0A8 | Mon - Sun: 24 hours daily |

| East Regina, SK Port Code: 0604 Sub. Code: 5817 | 3701 East Bypass Service Road Regina, SK (GPS address) 50°24'23.2"N 104°29'56.2"W | Mon - Sat: 06:00 - 18:00 Sun: 08:00 -16:00 |

| Edmonton, AB Port Code: 702 Sub. Code: 4492 | 12311 – 184th Street Edmonton, AB T5V 1T3 | Mon - Sun: 24 hours daily |

| Halifax, NS Port Code: 009 Sub. Code: 2021 | 5271 Africville Road Halifax, NS B3K 5M1 | Mon - Sun: 24 hours daily |

| Malport, ON Port Code: 495 Sub. Code: 3006 | 7675 Torbram Road Mississauga, ON L4T 3L8 | Mon - Sun: 24 hours daily |

| Mississauga, ON | 7505 Bramalea Road Mississauga, ON | Mon - Sun: 24 hours daily |

| Moncton, NB Port Code: 206 Sub. Code: 2108 | 600 Hump Yard Rd Moncton, NB E1T 4T6 | Mon - Sun: 24 hours daily |

| Montreal, QC Port Code: 395 Sub. Code: 2414 | 4500 Hickmore Street St. Laurent, QC H4T 1K2 Tel. 514-734-2245 | Mon - Sun: 24 hours daily |

| Prince George, BC | 855 River Road Prince George, BC V2L 5M5 | Mon - Fri: 06:30 - 18:30 Sat - Sun: 06:30 - 13:30 |

| Prince Rupert, BC | 3100 Scott Road (from Highway 16 West) Prince Rupert, BC V8J 3P4 250-624-2124 250-624-2323 | Mon - Sun: 24 hours daily |

| Saskatoon, SK Port Code: 605 Sub. Code: 3215 | 1701 Chappell Drive Saskatoon, SK S7M 5J5 | Mon - Fri: 06:00 - 18:00 Sat - Sun: 08:00 - 16:00 |

| Vancouver, BC Port Code: 809 Sub. Code: 3373 | 17569 – 104th Avenue Surrey, BC V4N 3M4 | Mon - Sun: 24 hours daily |

| Winnipeg, MB Port Code: 504 Sub. Code: 3147 | 560 Plessis Road P.O Box 1620 Winnipeg, MB R3C 3Z6 | Mon - Thurs: 24 hours daily Fri: 00:00 to 22:00 Sat - Sun: 06:00 to 20:00 |

Truck service to all ports in Vancouver, Halifax, Montreal, and New Orleans

Supply chain agreements with:

- Halifax Port Authority and terminal operators Ceres and Halterm

- Port Metro Vancouver and terminal operators TSI Terminal Services, DP World, and Squamish Terminals

- Port of Quebec and terminal operator IMTT

- Prince Rupert Port Authority and terminal operator DP World

- Montreal Port Authority and terminal operators MGT and Termont

- Port of New Orleans

General comment on trucking and transport industry

- There was a pre-pandemic over-hype of automated trucking that drove down demand and interest for truckers.

- The pandemic increased need for truckers (because of a short bump in volume of goods), pulling people into the industry. An industry that only looked to have a very tight labour-market.

- Major supply chain changes in load and carry volumes increased until this year when that demand suddenly reversed.

- Right now is the bottom of the demand cycle for trucking and so we have a double negative impact on volumes happening right now.

- Now there are "too many" operators/driver/trucking companies/trucks compared to demand.

This situation has increased competition on major routes for intermodal trucking.

Part of CN's response to this was the purchase of TransX/H&R to decrease wages for intermodal trucking (especially in refrigerated container freight trucking).

Fuller explanation:

As you all know, this is happening in a very liberalized and unregulated trucking market.

In general, intermodal short-trip trucking volume is aligned with all long-haul cargo shipping volume. Long-haul cargo transport volume is aligned with consumption. There is currently low consumption, low volume, and therefore lower demand for intermodal trucking.

Consumption is way down across the board which means that intermodal trucking is in a rather "loose" labour market. Loose labour markets means downward pressure on shipping rates and therefore downward pressure on our wages.

Add to this the increased costs of trucking because of shifting to expensive technologies, more operators on the edge of bankruptcy but with less long-term overhead than established corporations like CN and huge increases in debt/lease costs, sustained high price of fuel, and general costs of living.

All together you get increased competition between established companies with unions and "start-up" or less unionized companies.

The major routes that we are seeing a collapse in intermodal trucking are the same places we had an opportunistic increase in trucking company starts during the pandemic boom in consumption. Montreal-Toronto and Toronto-Moncton.

This is all happening across North America.

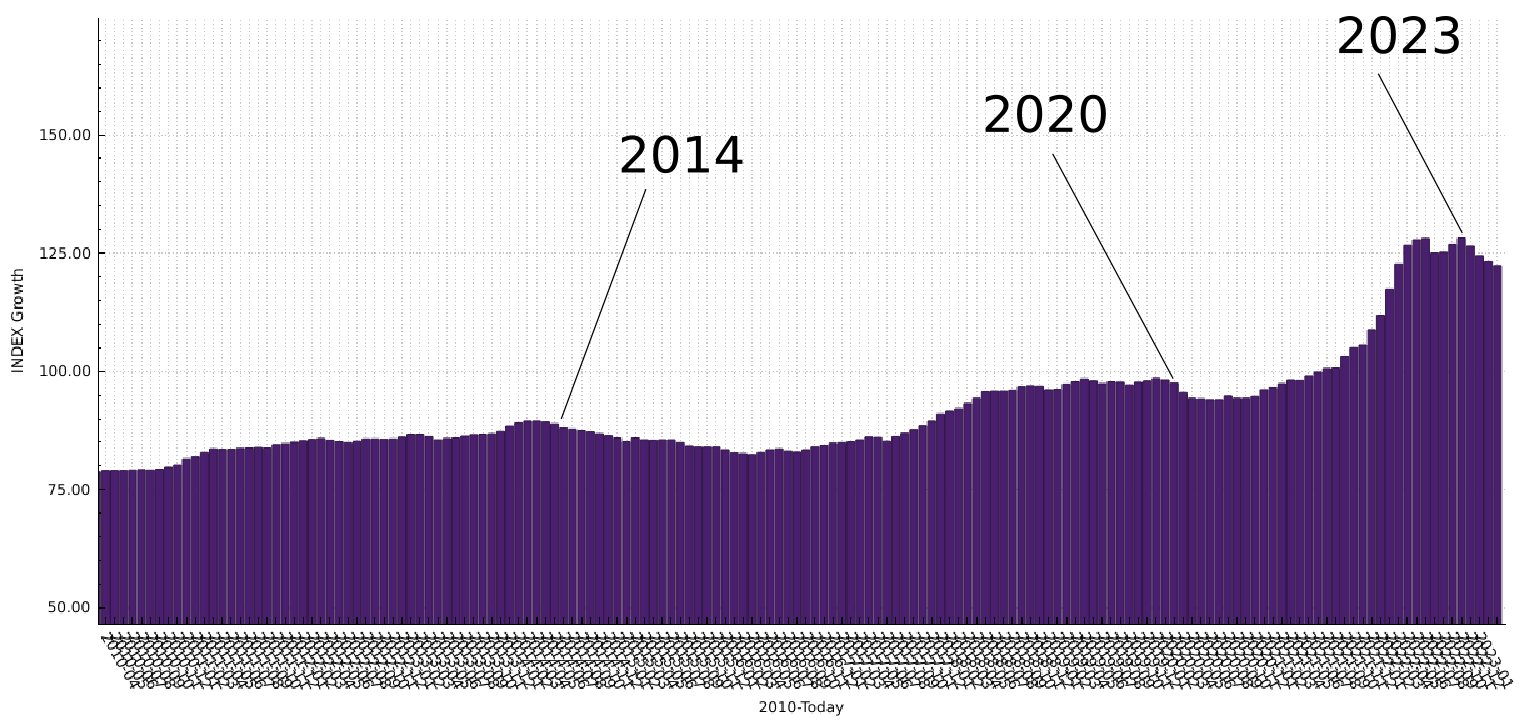

Here is a graph of Trucking growth since 2010.

Marine Road Rail

Marine Road Rail