OEB Decision on Enbridge Rates

A new decision against Enbridge by the Ontario Energy Board to Enbridge's proposed rate changes.

This is the second decision of the OEB on the merged Union Gas and Enbridge Gas Distribution's effects on their rate adjustments based on estimated real costs. There is likely significant impact on revenue generation and operations spending at Enbridge if this decision is unaltered.

The change is on the amortization period for cost recovery, which will directly change the way that Enbridge is able to find financing and the costs of that financing for new connections.

The Ontario government is keen to intervene here on behalf of Enbridge, but I am unclear how they can over-rule all OEB decisions here. Also, it seems as though Enbridge is on the wrong side of the OEB's accepted risk calculations for investing in Natural Gas.

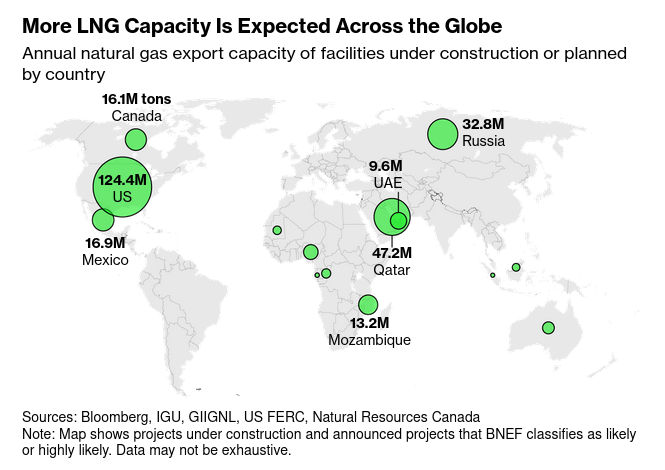

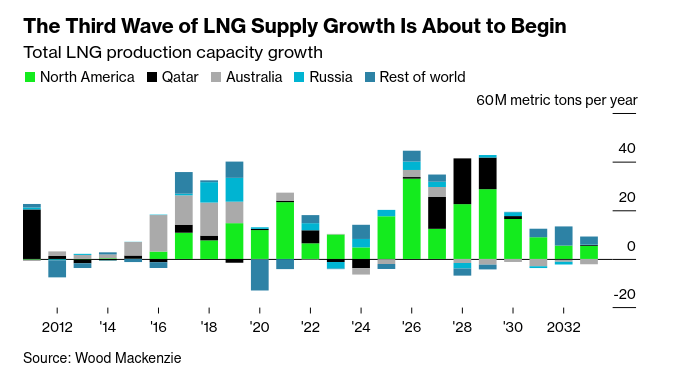

From first glance, I think that the OEB is correct that Enbridge is overstating expected revenue from selling gas. Even as production of natural gas for LNG export is expected to increase over the short term (see at end of document), there is a drive to reduce natural gas for local domestic use.

The decision was based on the OEB's finding that the energy transition is already in motion and that natural gas assets will likely become stranded assets in the foreseeable future:

"The energy transition poses a risk that assets used to serve existing and new Enbridge customers will become stranded because of the energy transition. Enbridge has not provided an adequate assessment of this risk to demonstrate that its capital spending plan is prudent. The stranded asset risk affects all aspects of Enbridge's system and its proposals for capital spending on system expansion and system renewal."

OEB determined that Enbridge needs to put more emphasis on monitoring, repairing and life extension of its system so that replacement projects are only implemented where absolutely necessary in order to address the stranded asset risk in that context.

In addition, the OEB:

Denied Enbridge's proposed recovery of \$156 million of Pension and Other Post Employment Benefit expenses recorded in the Accounting Policy Changes Deferral Account related to the pre-2017 Union amortized actuarial gains/losses

I would point out that stranded assets for natural gas are not really the current functioning natural gas pipelines, but the lack of demand for natural gas over other forms of energy in the near future. I assume that this includes any idea that natural gas will be supplemented with Hydrogen as outlined in the recent document of the government around net zero transition for electricity.

The OEB is saying that the cost recovery is too optimistic because use of natural gas at the "small scale consumer" will decline, not grow, so investment should be maintenance and not expansion, which means revenue growth is less important. The analysis that natural gas demand will decline is likely based on the cap and trade estimates from the government.

There were some other changes around how the Natural Gas Vehicle program needs to be a separate subsidiary from the regulated entity.

Summary here:

https://www.oeb.ca/sites/default/files/backgrounder-EGI-EB-2022-0200-20231221-en.pdf

Article regarding the decision here:

https://www.tvo.org/article/why-the-ford-government-wants-to-overrule-ontarios-energy-board

Note that the Ford government appears poised to reverse/overrule the decision.