TransMountain Pipeline

600,000 barrels a day#

With the rise in oil prices, the TransMountain Pipeline is back in the headlines. Also, because it is actually going to come online at some point soon.

- TransMountain capacity: 600,000 barrels a day

- Current capacity of the western pipline: 300,000 barrels a day.

- New total: 890,000 barrels a day

- Age of current pipeline: 70 years.

- Purchased at C$4.5 billion ($3.3 billion)

- Canada has spent: C$31 billion since purchasing it.

The destination of the crude is up for debate and where it goes affect where other oil flows:

Could be:

- A dozen refineries along the US Pacific Coast (Chevron Corp., BP Plc and Marathon Petroleum)

- Currently Saudi and/or Iraq oil

- Not really set-up to refine Canadian crude.

More likely:

- The alternative: the Asian market

- California cannot refine heavy Canadian oil

- Chinese oil shippers are ready to take full tank loads to Asian refineries

Current cost overruns---and subsequent price increase for transport---now means oil companies want cheaper oil transport. The price is paid by each company who wants to lease part of the pipeline's capacity. Near $11 a barrel right now. Any reduction in price will be an extra subsidy to oil companies.

BUT!

- Less than 70% of the new capacity may be used (so, only 440,000 barrels a day may come online).

- Canadian Natural and Cenovus Energy Inc. will have to increase production.

- Canada’s oil production will have to grow more than 900,000 barrels a day.

- Total estimated impact by 2030: 6 million barrels a day

All of these options will impact the price of Western Canadian Select. Reducing the $17 a barrel reduction in price compared to WTI, gaining companies more money.

Subsidies are everywhere for oil an gas.

What's the real problem? None of this actually makes any economic sense if Canada is to meet its climate obligations. And, makes almost no sense if the world is to meet its climate obligations---even under Net Zero by 2050.

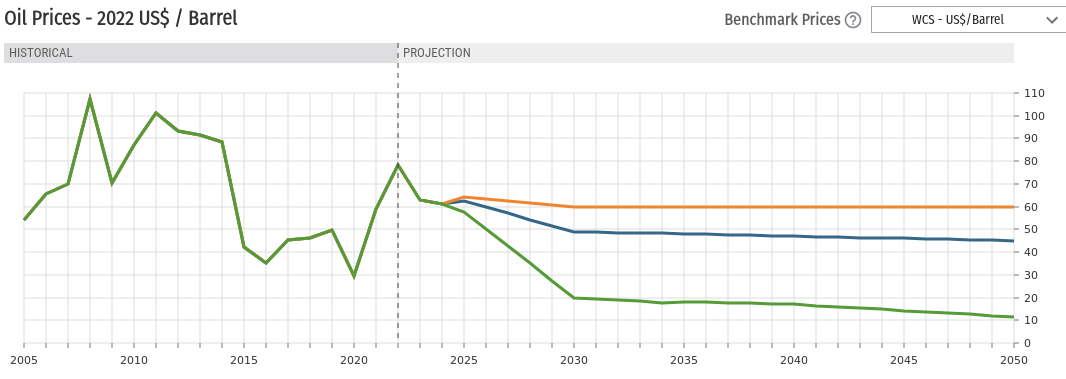

Here is the prices of oil in the different scenarios:

Under a global net zero scenario, the price of oil falls through the floor and not much of what is described above is economically sustainable. When prices fall this much, it isn't a market that drives production, it is a controlled production supply.

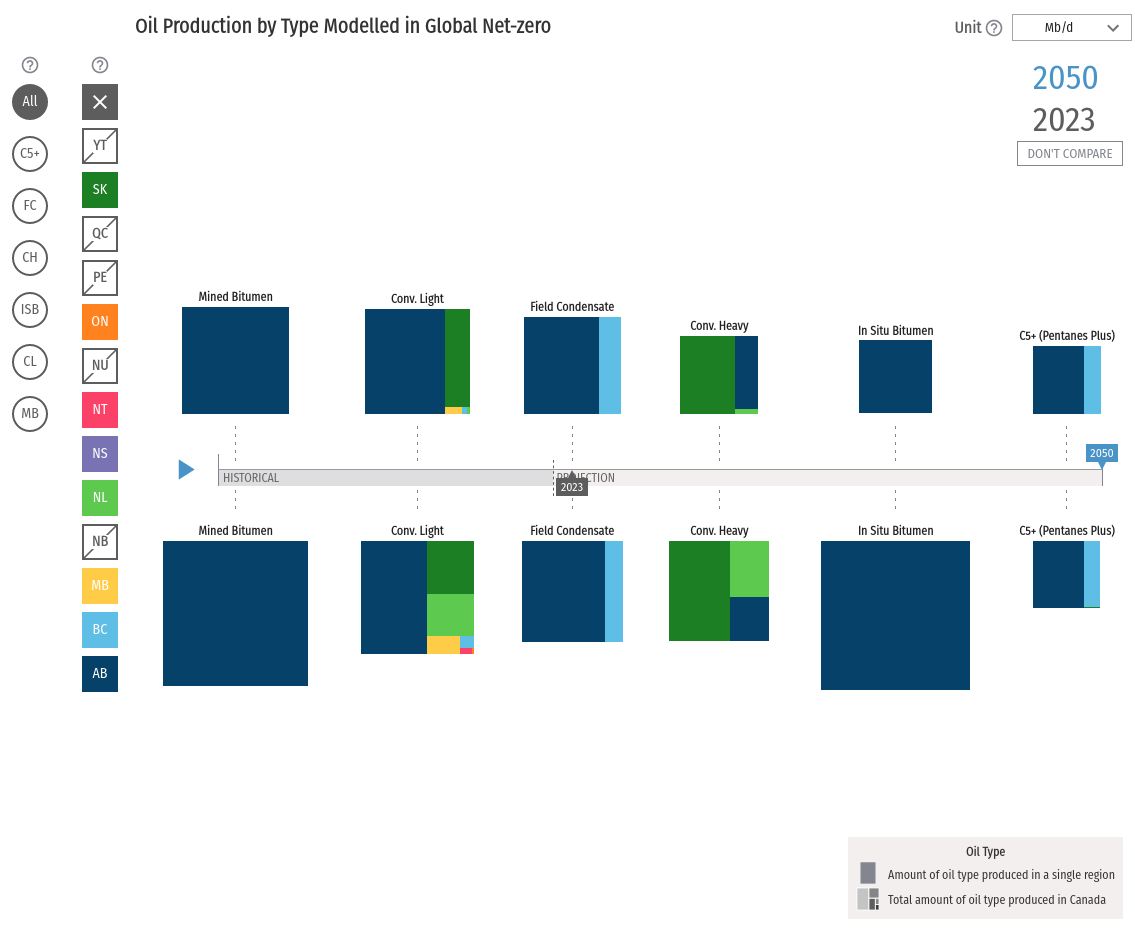

As an example of current projections and then compared to a global net zero, below is the different levels of output under two scenarios.

The first scenario is the current investment projection for output. Below that is the 2050 production levels we need to be at to reach Net Zero under a global effort for Net Zero.

Keep in mind that this production level has to be sustained for 20 years at a price that is essentially 1/5th the price it is today---a (real) price never seen on the market.

Current projections#

Above the bar is the expected production in 2050, estimated by volume of the squares.

Below the bar is the current production by type and province in 2023.

Global net zero#

Here is what oil production looks like under a global net zero.

Above the bar is where production would need to be in 2050. Below, is where it is now.

Peak Oil#

- Peak oil consumption, but no reduction

- Peak oil before 2030

- Natural gas will continue to rise.

The International Energy Agency sees the peak of production coming, but it does not think that there will be a reduction in production anytime soon. This is because demand for oil will be sustained.

World oil demand remains on track to grow by 2.2 mb/d in 2023 to 101.8 mb/d, led by resurgent Chinese consumption, jet fuel and petrochemical feedstocks. In 2024, naphtha and LPG/ethane, especially in China, will dominate an overall increase of a more modest 990 kb/d, to 102.8 mb/d, reflecting below-trend GDP growth and a structural decline in road transport fuel use in major markets. (IEA)