Canadian Cap and Trade

Question#

- Explain the new announcement on the Cap and Trade by the government of Canada.

- Outline the impact of the announcement on energy sector workers.

- Outline the impact of the announcement on employers in the energy sector.

Summary#

- The system is focused on the reducing emissions from the production of oil and gas, not the use of oil and gas.

- Canada Cap and Trade system will not come into effect until 2030.

- The cap is set at an achievable level using currently available technology. A level that looks to have been set by the industry: 35 to 38 percent below 2019 levels.

- There are significant flexibilities in the cap.

- Draft regulations will be released in 2024.

- Reducing energy intensity of production of the oil and gas sector alone is unlikely to reduce emissions significantly. Reduction in use (demand) is the only way to achieve net zero goals.

Definitions#

Externalities#

Under the dominant form of economics (neoclassical theory) negative or positive impacts on nature or the society are generally not counted in a firm's costs of production.

Externalities are the impacts of individual firm's operation that are not accounted for by that firm.

Pollution, climate change, or negative social consequences of their production process or product are examples of externalities.

In response, governments try to incorporate externality costs in firm operations through regulation.

Carbon dioxide is not an externality, climate change is. Carbon dioxide pricing is the process of commodification of product causing the externality of climate change.

Scopes of emissions#

-

Scope 1: emissions from production. Running a boiler.

-

Scope 2: emissions from consumption. Buying electricity generated from natural gas for use in production.

-

Scope 3: emissions the firm is responsible all along its supply chain not covered by Scope 1 and 2. End product is diesel burned sold to a truck company and burned.

Carbon Pricing#

Carbon pricing is an activity by governments to assign a price to carbon (and other greenhouse gasses) as an externality.

The process of assigning a price to something that did not have a price is known as commodification.

Carbon pricing is the commodification of greenhouse gases in such a way as to create a price to represent the negative impact of those greenhouse gases.

The carbon price is an attempt to correct for neoclassical economics' inability to correctly (or at all) price the costs of climate change into a firm's production costs.

The pricing of carbon relies on the theory that the free market can operate effectively if some externalities are priced efficiently.

By introducing prices for carbon the idea is that less carbon will be produced because the price will have risen for those who produce carbon compared to those firms who do not.

In addition, the process of carbon pricing usually depends on a state-established market in trading commodified carbon. This market helps to set a market price for carbon and allow a more efficient payment process.

Carbon pricing requires the establishment of a new measuring, accounting, and pricing mechanism.

Carbon Taxes#

Carbon "Taxes" are a government regulatory charge created for consumers of goods to pay at time of the purchase of that good. The purpose is to increase the cost of goods (and services) made with higher levels of emissions.

A carbon tax is intended to capture some of the externality costs of carbon; the price level will signal to the consumer products made with different levels of carbon pollution.

The tax is an attempt to adjust prices for some products to push consumers towards lower carbon (and therefore lower priced) goods and services.

In many cases, the carbon tax is collected and then redistributed back towards consumers hit with higher prices for goods that have no alternative. Some of those revenues are also directed towards the creation of lower carbon alternatives.

Carbon Cap and Trade#

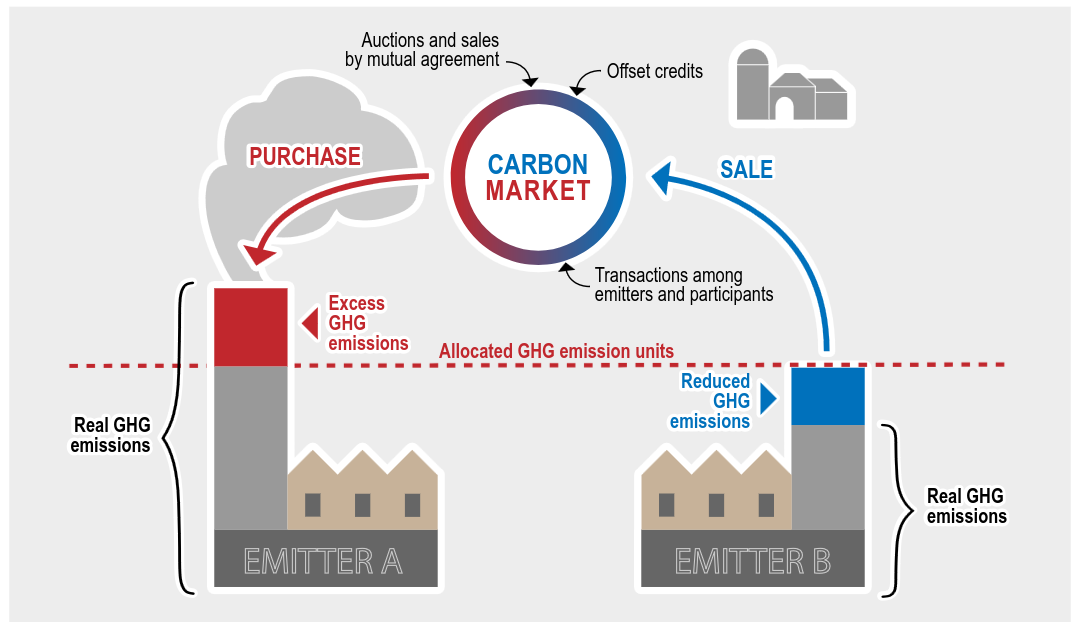

Focused on producers, the "cap" is a regulatory cap on emissions of carbon in production. The regulation sets a ceiling of total carbon the government wants to allow and then a clear timeline for reducing the total carbon produced.

Once carbon is priced effectively, a cap helps sets the price on a certain volume of carbon produced.

A credit system is then created accounting for the amount of carbon that can be produced under that cap.

The carbon credit represents a specific amount of carbon you can produce under the cap. Those credits are assigned through some quasi-market process across all carbon emitting producers.

Since there is more carbon produced than under the cap, the companies that produce using carbon must pay into a fund for more credits.

Some producers will transition to lower carbon production faster than others. This creates an excess in carbon credits.

A market in carbon credits is created and supported by the government so producers who produce with more carbon emissions can "trade" (buy or sell) excess carbon credits.

This is supposed to do two things:

-

Create a market-priced incentive to reduce carbon emissions faster than your competitors. If you reduce your carbon emissions, it costs less money because you can sell unused credits to other firms.

-

Creates an increased cost for companies who do not invest in lower emission production as they must purchase extra credits at a real cost.

Over time, the cap of total carbon is reduced by the government. This is supposed to cause private capital investors to make the decision to invest their money in transition to lower cost (lower carbon) processes. This is done through reducing the oil and gas burned in the production process or investment in technologies that capture the carbon before it is released.

Applied to the oil and gas sector, the focus is almost entirely on the carbon efficiency of production. Reducing carbon emitting (energy) intensity of producing a unit of oil or gas.

Quebec's graphical explanation of their carbon cap and trade system:

Background#

Canada's Liberals promised the introduction of a federal Cap and Trade system for carbon emitting industries in Canada officially in 2021.

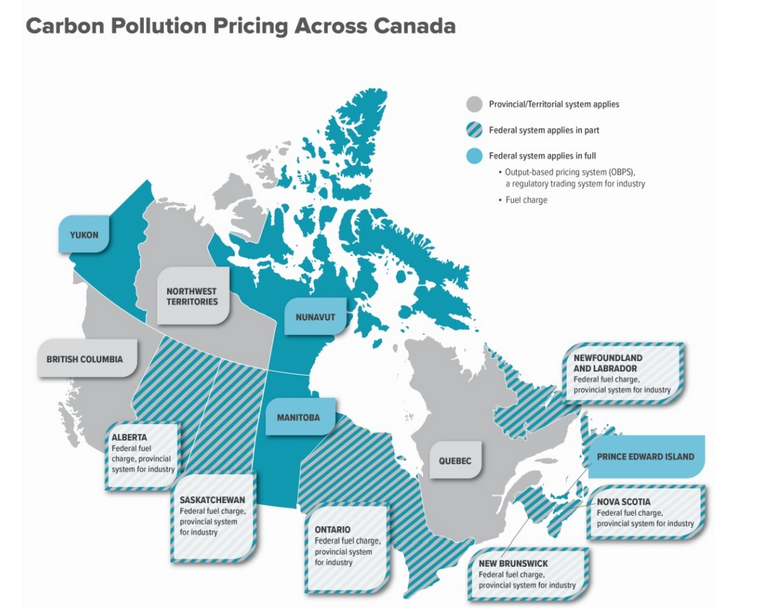

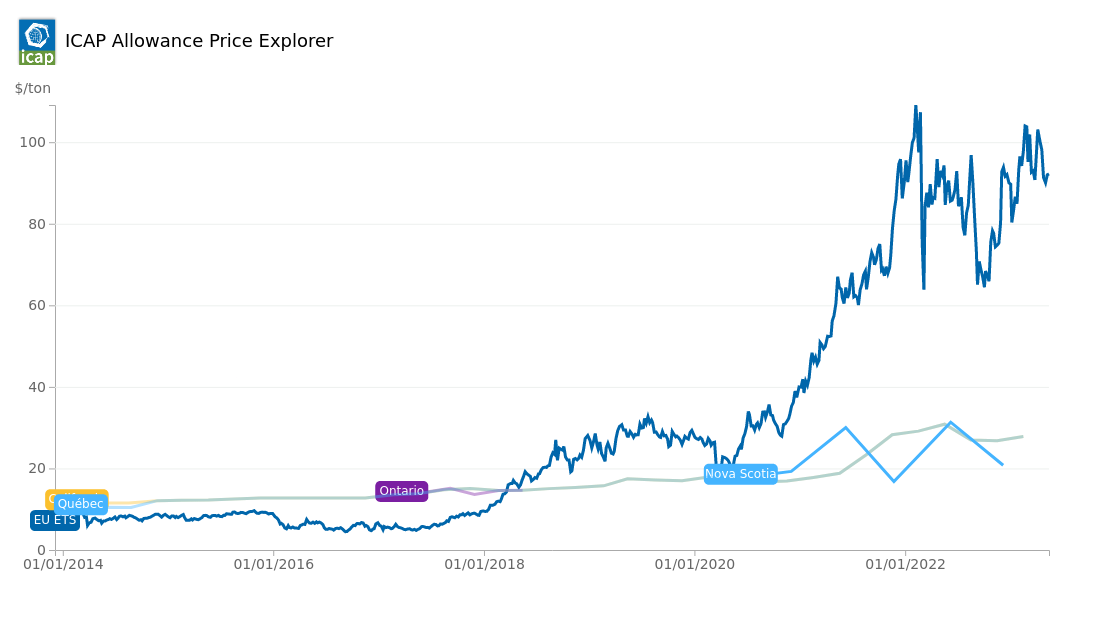

At the provincial level, Quebec already part of California's cap and trade system called the Western Climate Initiative's (WCI) carbon market. Ontario was in this market briefly under the Liberals January 1, 2018 to July 3, 2018. Nova Scotia has joined the market on May 11, 2018. and remains in the program.

Canada already has a carbon tax (federal fuel charge) and an Output-Based Pricing System that operates as a quasi-trading system in carbon.

The Output-Based Pricing System and the Greenhouse Gas Pollution Pricing Act was challenged by some provinces, but was upheld by the courts.

Canada's current system of carbon pricing:

Canada's announcement for Cap and Trade#

Some details were released of the Canadian Cap and Trade system Thursday, December 7, 2023.

- Applies to the oil and gas sector

- Draft regulations due mid-2024

- 2030 start date

- Will apply to direct (Scope 1) greenhouse gas emissions. (And, perhaps to some of Scope 2 emissions only based sources of energy purchased.)

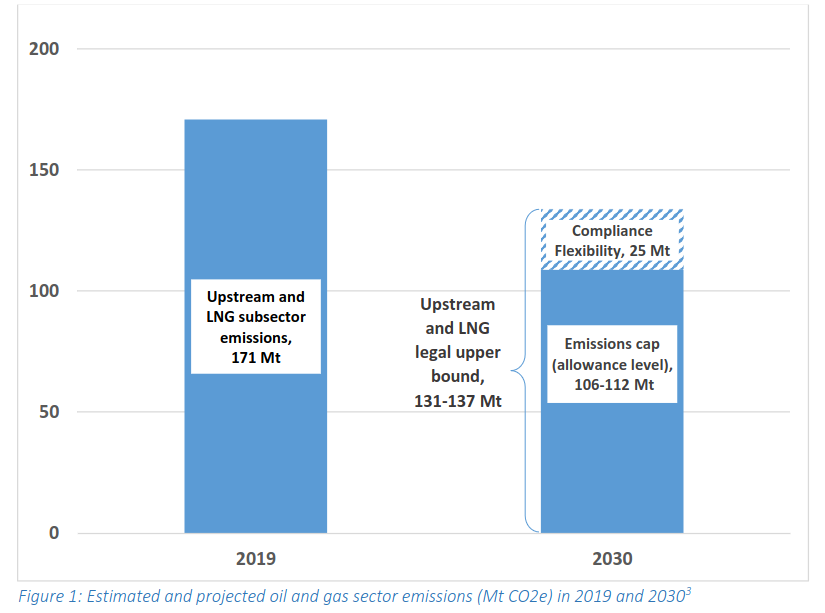

- Proposed cap: 2030 emissions at 35 to 38 percent below 2019 levels

- Flexibilities: emit up to a level about 20 to 23 percent below 2019 levels.

- the original 2030 emissions reduction target was 42% below 2019 levels.

- Emissions covered: carbon dioxide, methane, nitrous oxide (and

others)

- emission allowance will be equivalent to one tonne of carbon dioxide equivalent emissions (CO2e).

- "Oil and Gas" includes:

- upstream oil and gas facilities

- offshore facilities

- liquefied natural gas facilities

- The system's flexibility in pricing and application is large and promises to adjust to needs of the industry.

Reason given for regulating emissions of the oil and gas sector this way:

- Upstream represents 85% of the sector's emissions.

- Oil and gas sector accounted for 28 percent of national emissions in

2021

- second only to the transportation sector at 22 percent (because it burns oil and gas).

- Canada's international commitments are Net Zero emissions by 2050.

The announcement comes after extensive feedback from the sector. The discussion paper released in 2022 outlined two options for either a cap and trade system or a modified carbon pricing (tax) system.

The cap side of the Cap and Trade system announced will force companies to reduce carbon emissions from the production of oil and gas a level estimated achievable under current technology.

If currently available alternative technology for the sector's production processes are implemented, the impact of the carbon cap will be negligible. Alternative technologies include electrification of the process.

Many of these changes to the sector have already been announced and are underway.

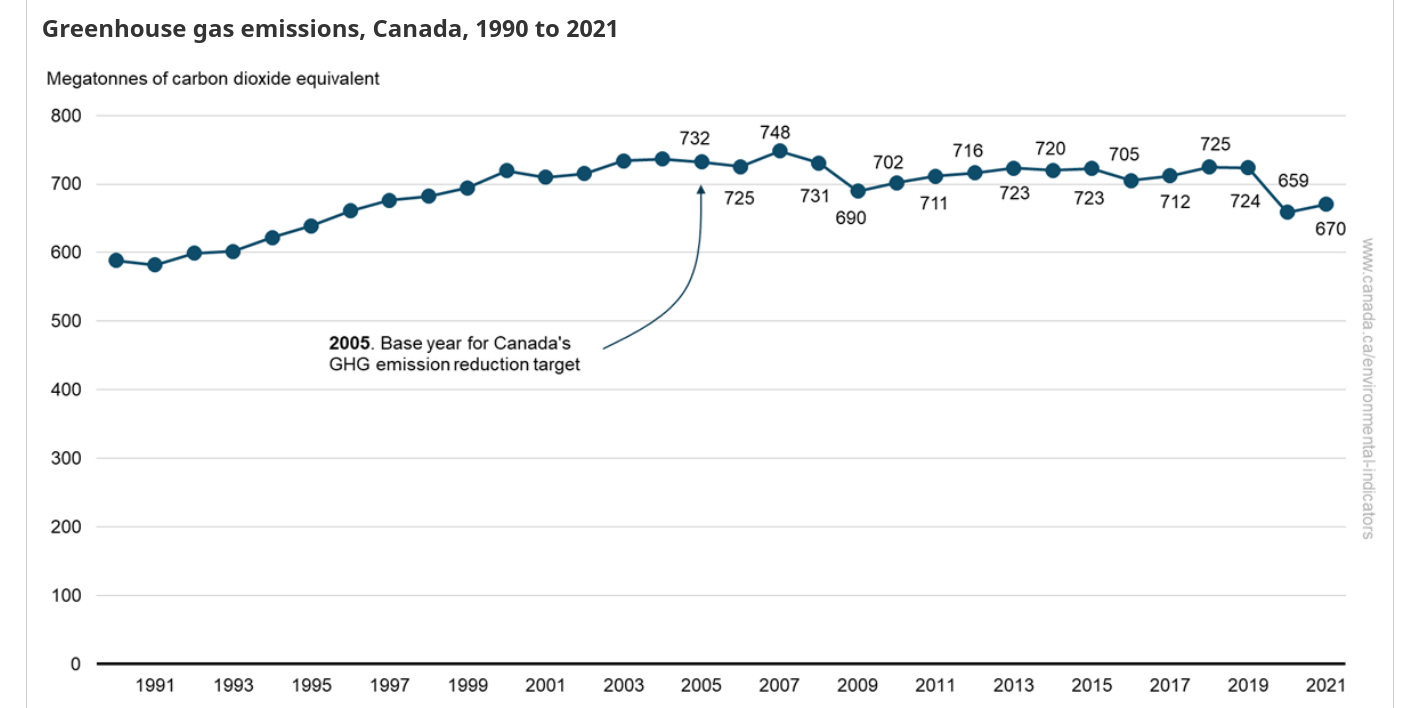

The government has provided this graphic to show the impact of the cap on carbon emissions from this regulation:

Analysis#

Caveat: Many of the details of the Cap and Trade system will not be released into mid 2024.

The success of Cap and Trade systems in reducing emission, similar to any other carbon pricing system, rests on the price of carbon.

To date, California's carbon pricing system used by Quebec and Nova Scotia sets the price of carbon well below its European peers. This has resulted in allegations of green washing given the price is too low to drive shifts in production or use.

The stated regulatory goal of Canada's Carbon Cap and Trade system is to facilitate the introduction of current oil and gas energy efficiency technologies at a slightly faster speed than would be facilitated by the market alone. There is no reason to believe that it will not achieve this goal.

The reduction in oil and gas producer emissions is also a goal for the oil and gas producers. The shift to cheaper energy sources (that happen to be also less emitting) is ongoing in the sector.

Currently, Canada's oil sector is highly emitting as it uses oil and gas in the process of removing oil from the ground and pushing that bitumen along pipelines. The introduction of alternative electric-powered processes will significantly cut the emissions of the sector.

Reduction of methane emissions from transport and storage are necessary from a climate perspective. Regulations and support are necessary to upgrade extraction facilities and pipelines to reduce leakage along this gas supply chain.

Most of this could be achieved without a cap and trade system. However, since this cap and trade system agreed to by industry and implemented at the federal level could ensure this transition.

The benefit of this transition to lower energy intensity in the sector is more jobs. Shifting and increased investment in new energy technologies and fixing current gas pipeline infrastructure is labour intensive. These jobs could help offset the largest short-term threat to employment in the sector which is automation.

The flexibility built into the announced Cap and Trade mechanism is part of the government's response to the legal challenges to the Greenhouse Gas Pollution Pricing Act. Flexibility is part of the reason the federal government's has the ability to establish federal jurisdiction over carbon pricing.

In terms of effect on emissions, there is little doubt that reducing energy intensity emissions will reduce the growth rate of Canada's emissions.

However, a focus on reducing Canada's energy intensity has yet to provide a decrease in overall emissions.

By sector, emissions are largest in oil and gas production and transport which uses the products of the oil and gas sector.

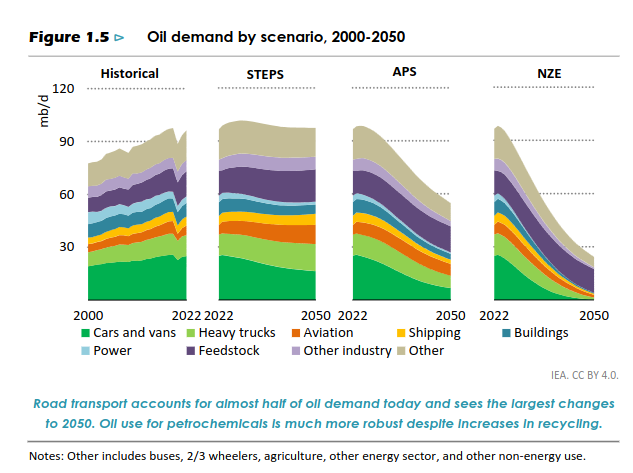

Net Zero at 2050 requires significant reduction in emissions over the next 25 years. The only way to reach this reduction is through reduction of both energy intensity of production and use of oil and gas products of transport.

Global Net Zero Emissions (NZE) versus current policies (STEPS) as outlined by the International Energy Agency.

Canada is also slated as one of the first countries that needs to reduce its production levels of oil for the world to reduce its carbon emissions. Part of this is because of the energy intensity of its emissions.

It is unclear if the proposed Cap and Trade reduction in energy intensity of this industry will be enough to delay that recommended reduction in production for a Net Zero world.